Case Study: Mobile-based MROCs for Qualitative Insights

Unilever engaged GeoPoll to gather in-depth insights on new products

Background

Brands are always looking to better understand their target audiences and how they interact with products and services, perceive brands and make purchase decisions. This is especially important for fast moving consumer goods, which have high turnover and are often purchased impulsively, leaving little time for consumers to weigh the pros and cons of a product against competitors. Unilever is one of the world’s largest FMCG companies, and owns over 400 brands around the globe. These include well-known food and beverage brands such as Knorr and Lipton, and home and personal care brands including Dove and Sunlight. Unilever’s Consumer and Market Insights group is known as one of the best market research arms of any multinational company, and uses a vast array of data sources to guide the company’s consumer-driven strategy.

Challenge

Unilever is constantly looking to improve upon existing products, test demand for new ideas, and better understand their customer base in each market. To do this, they conduct research through multiple channels, including analysis of retail data, store audits, and quantitative surveys. Qualitative data is also vital to understanding customers, as it provides rich context and details that cannot be gleaned from quantitative data. However, in countries such as Nigeria and Kenya, conducting in-person focus groups can be time-consuming and difficult due to infrastructure challenges, dispersed populations, and other factors. Traditional Market Research Online Communities (MROCs), which are most often conducted via desktop computer, are also infeasible for populations who access the internet most often through mobile phones.

Solution

Unilever’s Consumer and Market Insights group recognized the value of gathering qualitative data from its target audience in countries including Kenya and Nigeria, and sought to develop a better way to gather insights from these populations. The solution was mobile: By leveraging the wide reach and accessibility of mobile connectivity throughout sub-Saharan Africa, Unilever, GeoPoll and qualitative specialists AHA were able to develop a unique methodology that allows for in-depth, qualitative data to be gathered via respondents’ own mobile phones.

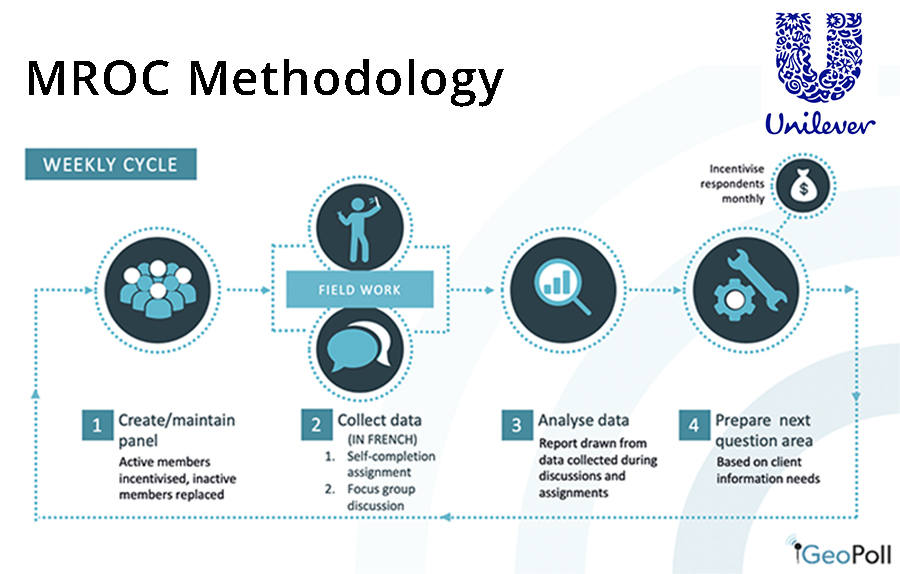

In this methodology, respondents are recruited and then placed into a mobile chat group, in which conversations can continue for a longer period of time than in traditional focus groups. Respondents are incentivized weekly or monthly for their participation, and new respondents are brought in to replace those that have become inactive. A specialized moderator guides the conversation by asking specific prompts and encouraging group members to discuss topics among themselves. Due to the mobile nature of the chat, prompts can include requests for photos or videos of products being used, and respondents can participate at a time that is convenient to them.

Impact

GeoPoll and AHA have now conducted mobile-based MROCs in Kenya, Nigeria, Ghana, South Africa and Cote D’Ivoire. Leveraging GeoPoll’s database of respondents and expertise in conducting research throughout sub-Saharan Africa, our clients have been provided with actionable insights not only in FMCG categories but financial services, media and other sectors as well. The rich insights collected include videos of respondents opening and using products, reactions to potential new product types or product packaging, and much more. Using this data, our clients are able to refine plans for new products, gauge reactions to changes to existing products, and make more informed decisions based on the preferences of their target audience. In addition, GeoPoll’s wide reach allows us quickly to scale mobile-based MROCs to multiple countries in sub-Saharan Africa and around the world.