GEOPOLL REPORT: VOICES FROM CENTRAL AMERICA

Breaking Insights: The Harsh Realities and Future of Central America in 2025

A Region on the Brink: Survival, Migration, and Hope

The post GeoPoll Report: Voices from Central America appeared first on GeoPoll.

]]>The post GeoPoll Report: Voices from Central America appeared first on GeoPoll.

]]>The post Report: Youth Perceptions on Politics and Governance appeared first on GeoPoll.

]]>Understanding the perspectives of young people on politics and governance is crucial in shaping future policies and youth engagement strategies. GeoPoll’s conducted a survey in March 2025 to gauge their awareness, participation, and expectations regarding politics and governance in Kenya. Here are the key findings:

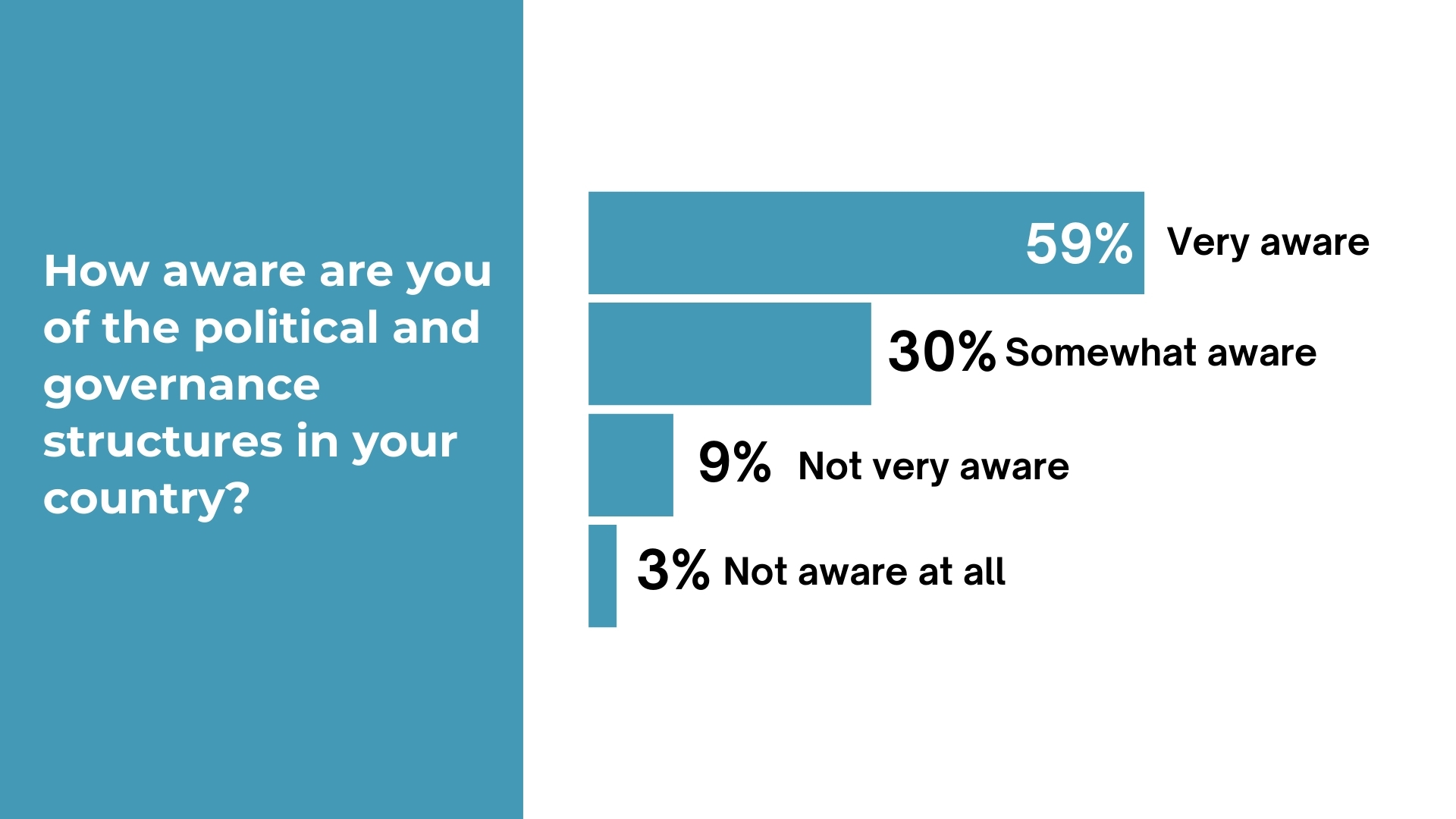

The survey data reveals respondents’ significant awareness and interest in political and governance structures. Notably, 59% of participants reported being very aware of these structures, while 30% identified as somewhat aware.

When asked about their level of interest in learning more about political and governance processes, 60% expressing a strong interest, and 30% indicating that they are somewhat interested. This highlights a robust desire for engagement and understanding of political processes among the youth.

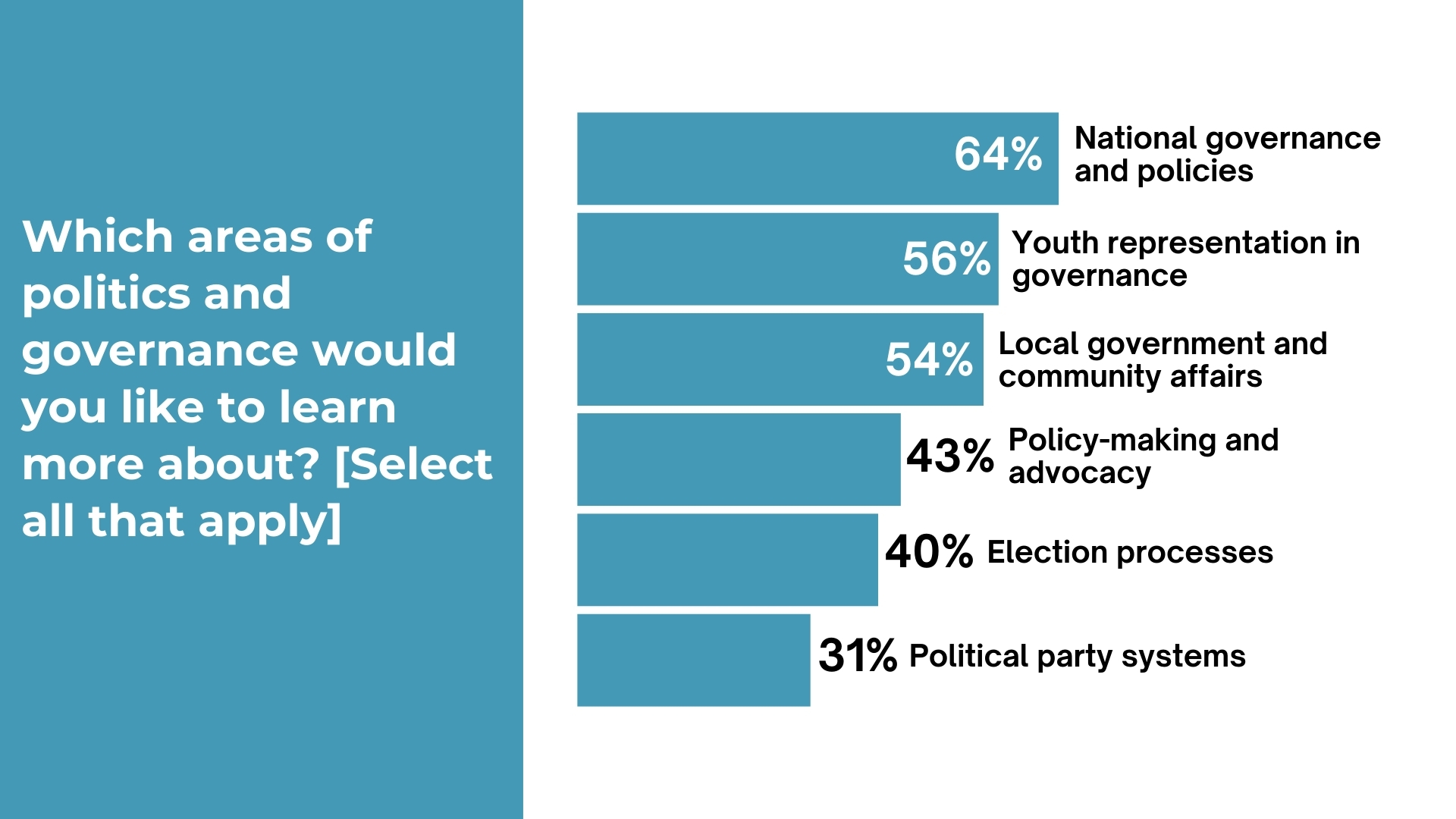

Respondents were asked about the specific areas of politics and governance they would like to learn more about. The most common area of interest was national governance and policies, selected by 64% of respondents. Youth representation in governance followed at 56%, while local government and community affairs were of interest to 54%. Policy-making and advocacy also gained considerable attention at 43%, along with election processes at 40% and political party systems at 31%.

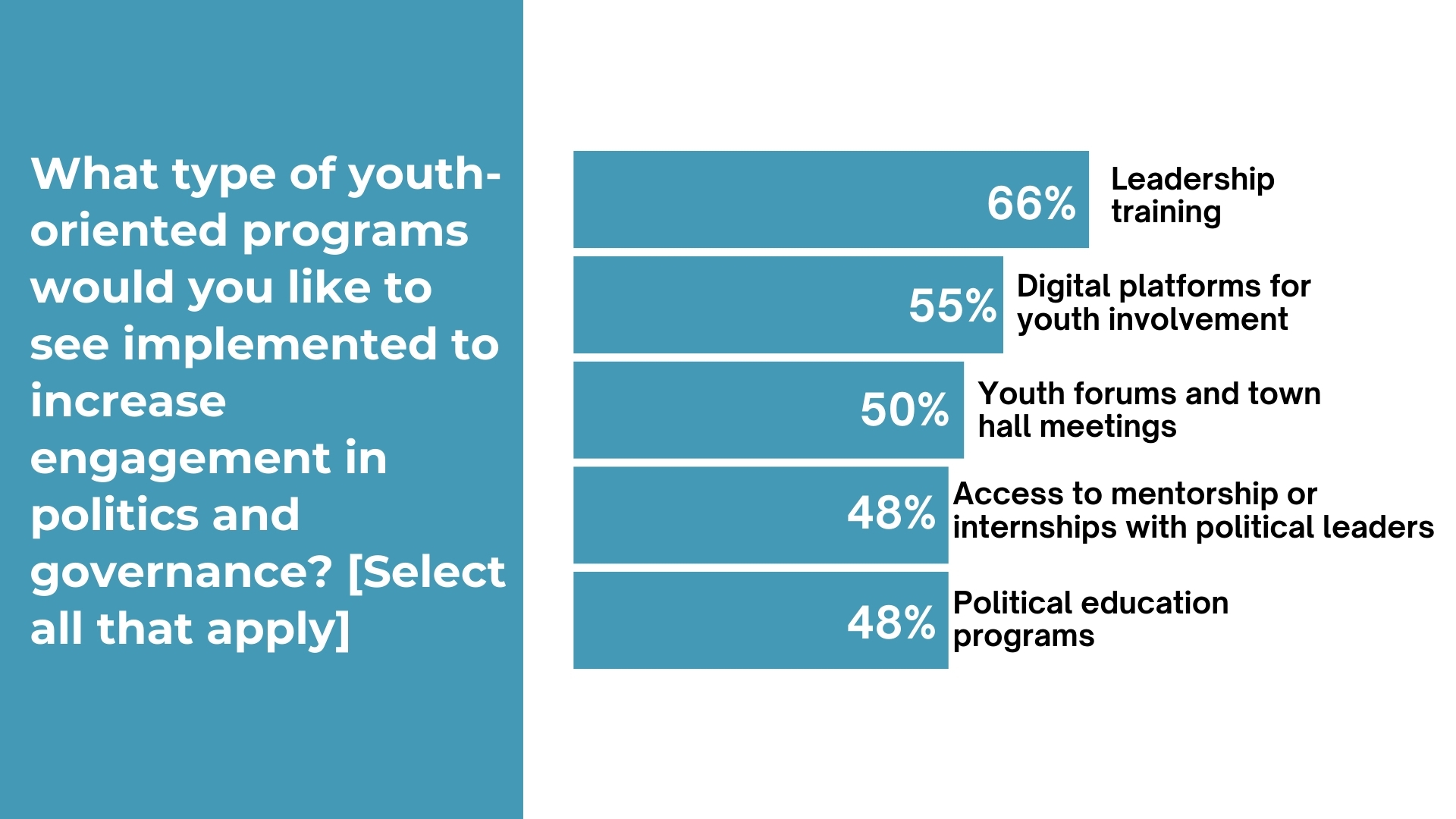

When asked about the types of youth-oriented programs that could enhance political and governance engagement, leadership training was the most favored option, with 66% of respondents supporting it. Additionally, 55% of participants endorsed using digital platforms for youth involvement, while youth forums and town hall meetings received support from 50% of those surveyed.

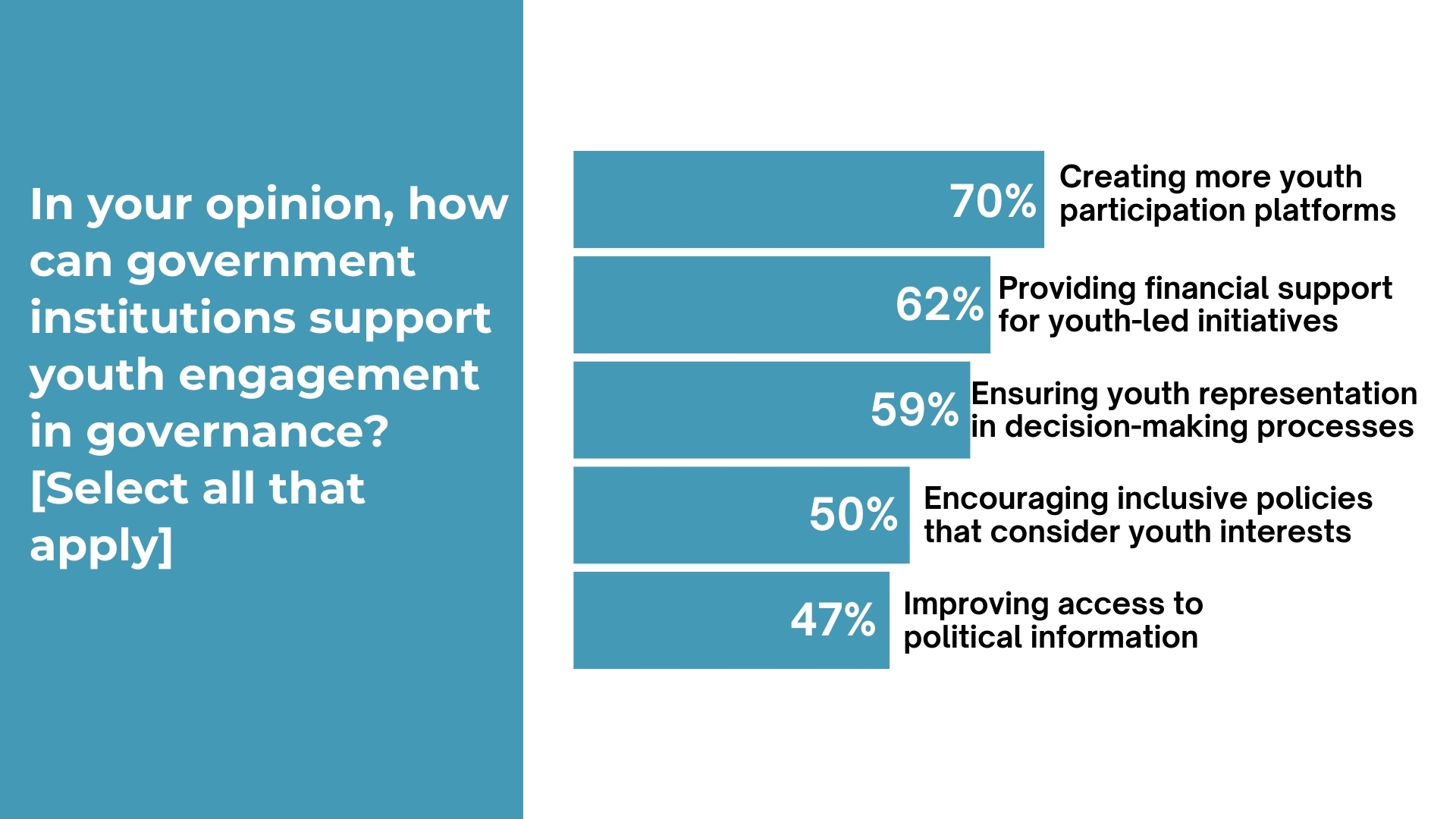

The survey participants highlighted several ways government institutions can support youth engagement in governance. The most popular recommendation was the creation of more youth participation platforms, supported by 70% of respondents. Providing financial support for youth-led initiatives was also a major priority, with 62% in favor. Ensuring youth representation in decision-making processes gained 59% support while encouraging inclusive policies that consider youth interests was selected by 50%. Improving access to political information was also cited as a crucial factor, with 47% of respondents advocating for better information dissemination.

According to Youth Democracy Cohort, while young people are historically active in Kenya’s public affairs, the country recorded a 5.27% drop in young voters in its 2022 general elections compared with the 2017 elections.

The survey found that 81% of respondents had voted in the last election, while 19% did not. Looking ahead, 94% of respondents indicated they intend to vote in the upcoming election, demonstrating strong electoral engagement among the youth, expected from the recent youth activism, including the 2024 widespread protests.

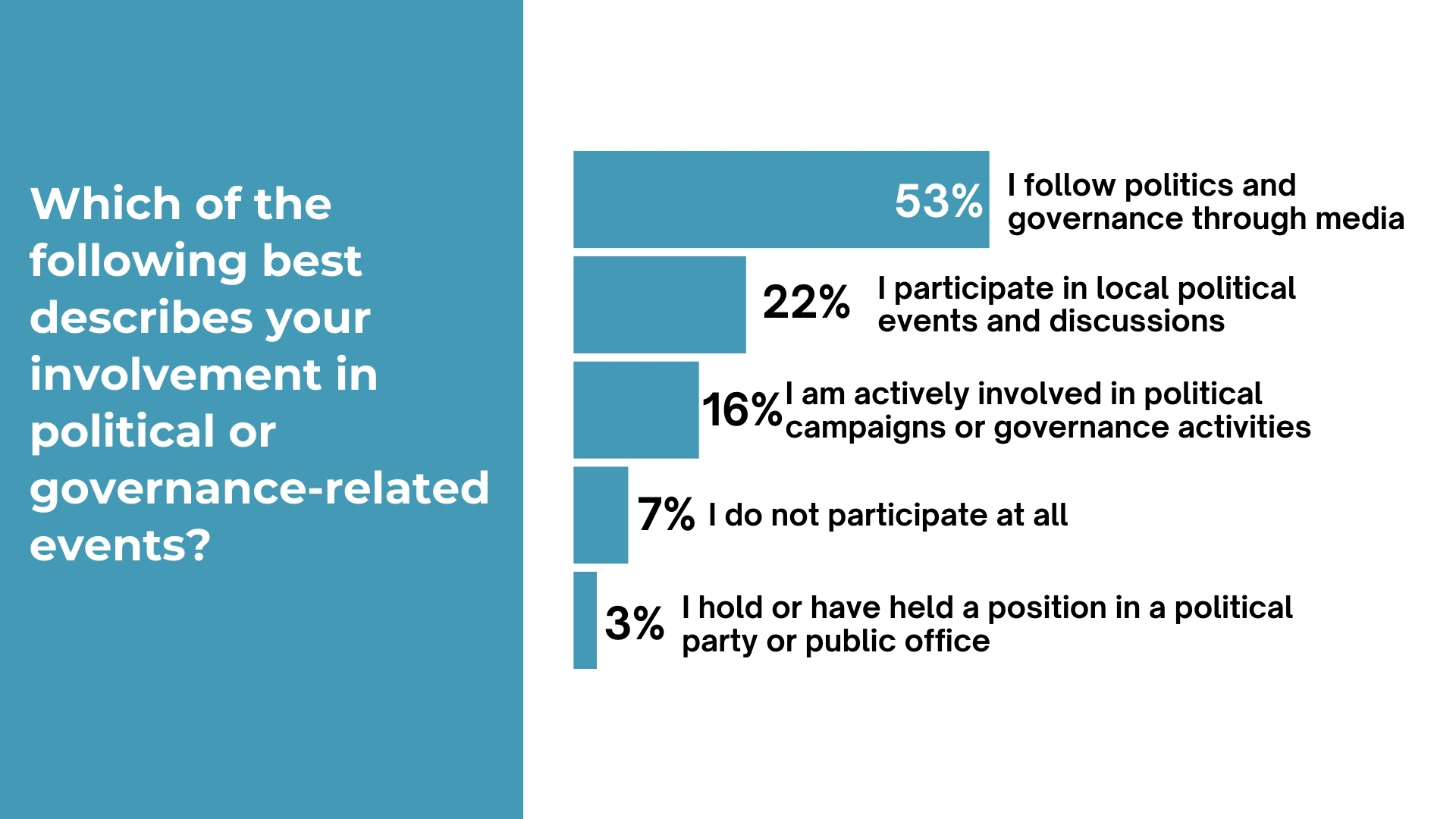

Regarding broader political involvement, 53% of respondents follow politics and governance through media. Another 22% participate in local political discussions, while 16% actively participate in political campaigns. However, 7% do not participate, and only 3% hold or hold a political party or public office position. The frequency of political participation also varied, with 36% stating they participate occasionally, 22% rarely, 18% frequently, 17% consistently, and 6% never engaging in political activities.

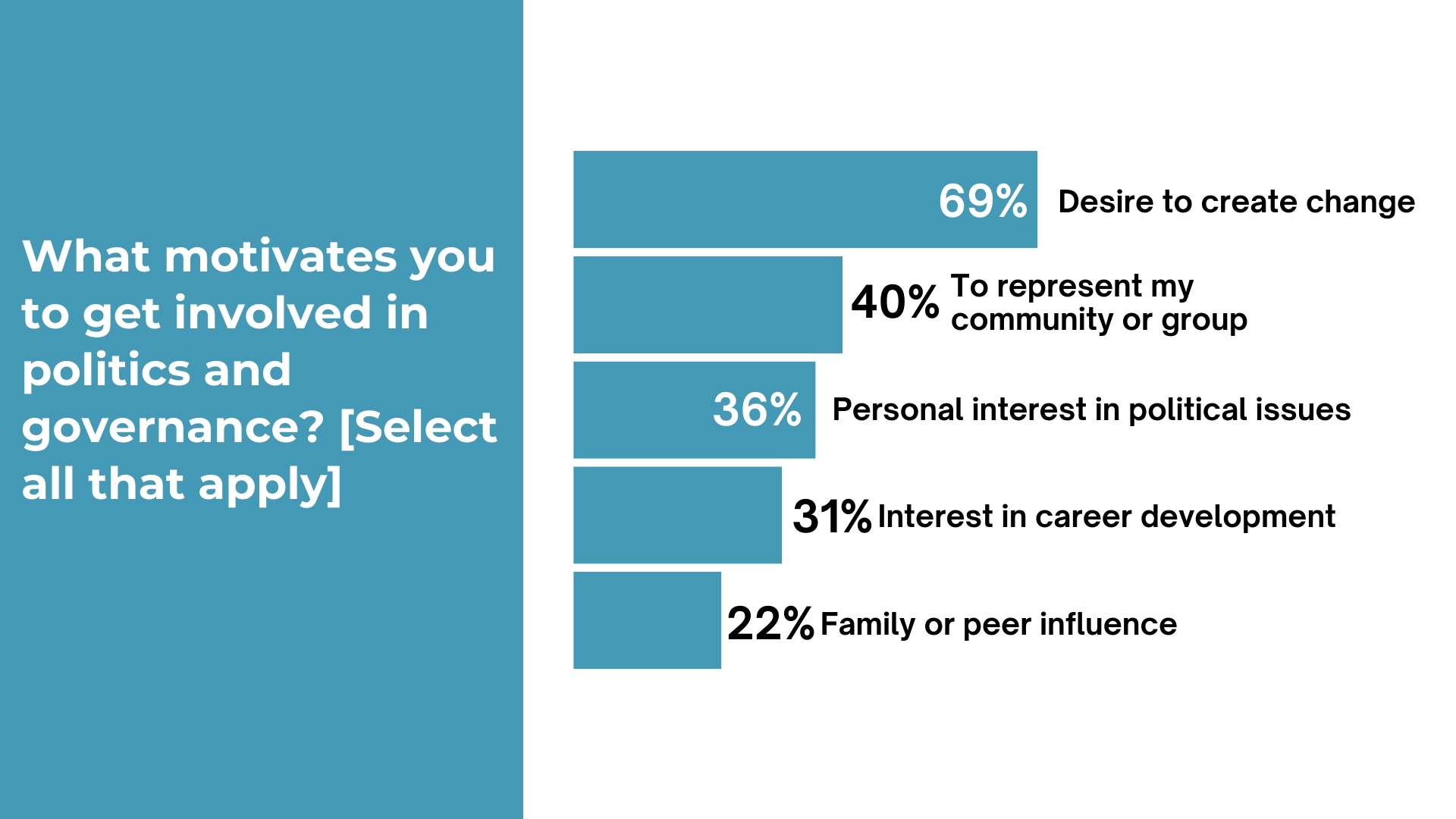

The primary motivation for political engagement among respondents is the desire to create change, with 69% expressing this sentiment. Other motivations include representing their community or group (40%), having a personal interest in political issues (36%), seeking career development opportunities (31%), and being influenced by family or peers (22%). These findings suggest that many young people see political involvement as shaping their society and influencing decision-making.

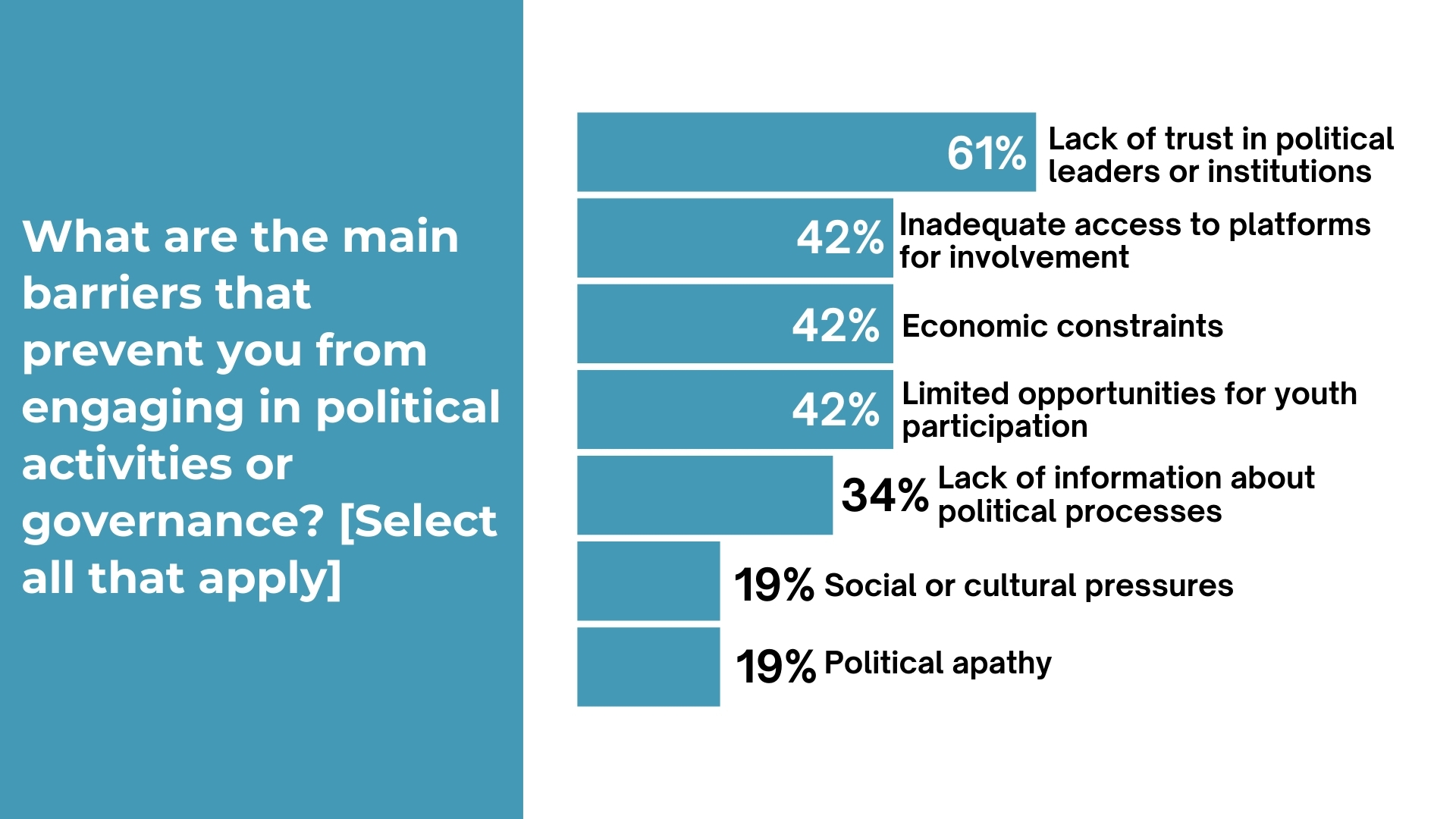

Despite their interest, young people face several barriers to political participation. The biggest obstacle identified was a lack of trust in political leaders and institutions, cited by 61% of respondents. Additionally, 42% pointed to limited opportunities for youth participation, economic constraints, and inadequate access to platforms as significant barriers. Another 34% felt that a lack of information about political processes hindered their involvement. Social and cultural pressures and political apathy were mentioned by 19% of respondents each.

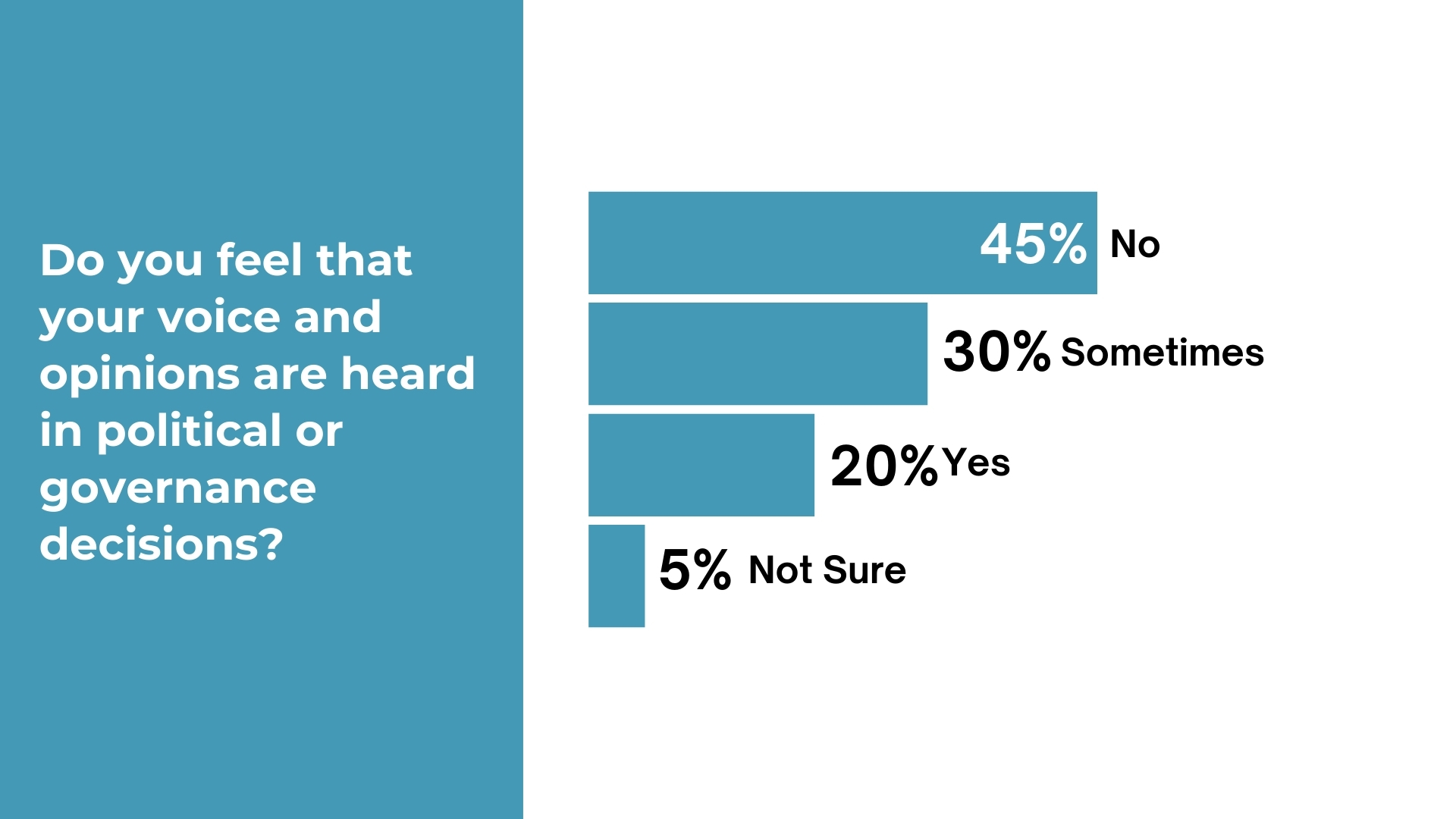

When asked whether they feel their voices are heard in political and governance decisions, 45% of respondents said no, while 30% said they are sometimes heard. Only 20% believe their opinions are genuinely taken into account. Similarly, when asked whether political leaders adequately represent the interests of young people, 55% responded negatively, while 24% believe they sometimes do.

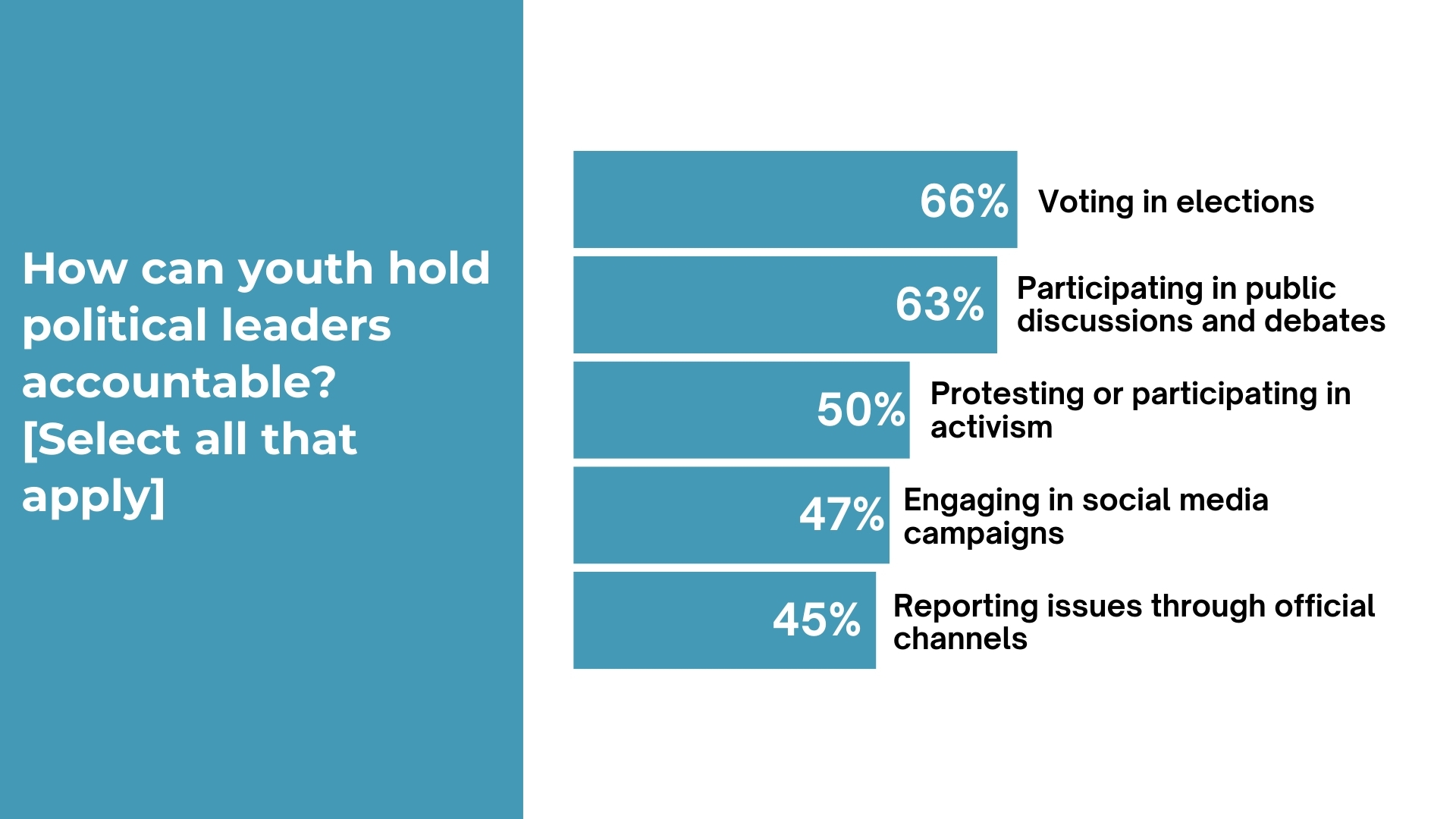

A substantial majority (80%) of respondents believe increased youth participation in governance can lead to greater political accountability. When asked how youth can hold leaders accountable, voting in elections was the most popular response (66%), followed closely by participating in public discussions and debates (63%). Other methods of accountability included protesting or participating in activism (50%), engaging in social media campaigns (47%), and reporting issues through official channels (45%).

The survey results indicate that while youth are highly interested in politics and governance, barriers such as lack of trust, limited access to information, and economic constraints hinder their full participation. To foster youth engagement, governments and organizations should invest in leadership training, digital platforms, and financial support for youth-led initiatives. Ensuring representation in decision-making processes and encouraging open dialogue will strengthen youth involvement and accountability in governance. These insights serve as a roadmap for policymakers, civil society organizations, and youth leaders to create an enabling environment where young people can actively shape their political future.

This Exclusive Survey was run via the GeoPoll mobile application on the 17th of March 2025 in Kenya. The sample size was 487, composed of random GeoPoll app users above the age of 18. Since the survey was randomly distributed, the results are slightly skewed towards younger respondents.

GeoPoll is committed to empowering youth by supporting organizations, policymakers, and governments in addressing future challenges young people face. Together, we can leverage data to drive targeted interventions, enhance youth well-being, and build more resilient systems for the future. Our mobile-based surveys provide a robust and proven method for capturing insights on youth perspectives, behaviors, and public perceptions, particularly in under-resourced regions.

Please get in touch with us to get more details about our capabilities, explore more on youth focused, or other topics in Africa, Asia, and Latin America.

The post Report: Youth Perceptions on Politics and Governance appeared first on GeoPoll.

]]>The post Fine-Tuning Audio-Based AI Models with Survey Recordings appeared first on GeoPoll.

]]>One of the most valuable yet underutilized datasets for fine-tuning speech AI models comes from survey interview recordings collected through CATI (Computer-Assisted Telephone Interviewing). These real-world, natural language conversations capture regional accents, speech patterns, socio-economic terminology, and sentiment variations—making them a goldmine for improving AI-driven speech recognition and analytics.

Pre-trained AI models serve as generalized speech recognition systems built on large datasets primarily sourced from media transcripts, scripted dialogues, and high-quality recordings. However, real-world applications—such as call centers, telephonic surveys, market research, and opinion polling—demand models that can:

Fine-tuning allows AI models to adjust their weights, phoneme recognition, and contextual understanding to perform better in these real-world conditions.

CATI survey recordings offer several unique advantages that make them ideal for AI fine-tuning:

Organizations seeking to improve speech recognition, transcription accuracy, sentiment analysis, or voice-based AI applications can fine-tune their models using real-world survey interview recordings. Whether it’s a tech company creating and improving voice assistants, a transcription service improving accuracy, or a research firm analyzing sentiment at scale – anyone, the process generally is:

The future of speech AI in multilingual, diverse markets depends on its ability to accurately interpret, transcribe, and analyze spoken data from all demographics—not just those dominant in global AI training datasets. Fine-tuning AI with survey interview recordings from CATI research can improve speech models to be more accurate, adaptable, and representative of global populations.

GeoPoll’s AI Data Streams provide a structured pipeline for accessing diverse, real-world survey recordings, making them invaluable for organizations developing LLM models that are based on voice or underserved languages.

With over 350,000 hours of voice recordings from over a million individuals in 100 languages spanning Africa, Asia, and Latin America, GeoPoll provides rich, unbiased datasets to AI developers looking to bridge the gap between global AI technology and localized speech recognition.

Contact GeoPoll to learn more about our LLM training datasets.

The post Fine-Tuning Audio-Based AI Models with Survey Recordings appeared first on GeoPoll.

]]>The post International Women’s Day 2025: Most Admired Women appeared first on GeoPoll.

]]>The chart below displays the 20 women named most frequently in response to the open-ended survey question across countries and genders. The numbers in the chart indicate how many times each woman was named per country.

| # | Name |

| 1 | Mother |

| 2 | Oprah Winfrey |

| 3 | Michelle Obama |

| 4 | Ngozi Okonjo Iweala |

| 5 | Wangari Maathai |

| 6 | Kamala Harris |

| 7 | Martha Karua |

| 8 | Myself |

| 9 | Jane Naana Opoku Agyemang |

| 10 | Margaret Kenyatta |

| 11 | Queen Elizabeth |

| 12 | My wife |

| 13 | Mitchell Obama |

| 14 | Chimamanda Adichie |

| 15 | Dora Akunyili |

| 16 | Lupita Nyong’o |

| 17 | Beyonce |

| 18 | Yaa Asantewaa |

| 19 | Hillary |

| 20 | Alakija |

Ranking by number of mentions

The survey revealed that, Mother emerged as the most frequently mentioned response by a significant margin—about one in every four participants chose their mother. This dominance highlights a powerful personal connection: mothers are often viewed as caregivers, role models, and key figures in shaping values, aspirations, and life paths.

Oprah Winfrey, Michelle Obama, Ngozi Okonjo Iweala, and Wangari Maathai—demonstrate that certain global icons resonate strongly across different regions. Each of these women has achieved significant acclaim or leadership in their respective domains:

Their visibility, achievements, and advocacy for various social causes likely contributed to their strong appeal among survey respondents.

Beyond these top figures, a diverse group rounds out the top 20: political leaders (e.g., Kamala Harris, Martha Karua), activists (e.g., Dora Akunyili, Yaa Asantewaa), entertainers (e.g., Beyonce, Lupita Nyong’o), and personal relations (“My wife,” “Myself”).

This variety demonstrate that admiration is multifaceted, with respondents valuing everything from personal relationships and everyday heroes to prominent public figures who inspire on a broader social or global scale.

Across the countries surveyed, “Mother” overwhelmingly emerged as the figure both men and women admire most. Below is a concise breakdown of the most admired women in each country, illustrating how personal and cultural icons resonate across different contexts.

| # | Name |

| 1 | Mother |

| 2 | Oprah Winfrey |

| 3 | Jane Naana Opoku Agyemang |

| 4 | Queen Elizabeth |

| 5 | Kamala Harris |

| 6 | Myself |

| 7 | Yaa Asantewaa |

| 8 | Michelle Obama |

| 9 | Chimamanda Adichie |

| 10 | Dora Akunyili |

| 11 | Beyonce |

| 12 | Gifty Anti |

| 13 | Samira Bawumia |

| 14 | Prof. Jane Naana Agyemang (The vice president of Ghana) |

| 15 | Hilary Clinton |

| 16 | My girlfriend |

| 17 | Nana Ama Mcbrown |

| 18 | Florence Nightingale |

| 19 | Rihanna |

| 20 | Ama Atta Aidoo |

Ranking by number of mentions

| # | Name |

| 1 | Mother |

| 2 | Wangari Maathai |

| 3 | Michelle Obama |

| 4 | Martha Karua |

| 5 | Oprah Winfrey |

| 6 | Margaret Kenyatta |

| 7 | Kamala Harris |

| 8 | Mitchell Obama |

| 9 | Lupita Nyong’o |

| 10 | Myself |

| 11 | Celine Dion |

| 12 | Hillary Clinton |

| 13 | Millie Odhiambo |

| 14 | Mama Ngina |

| 15 | Akothee |

| 16 | Diana Bahati |

| 17 | Beyonce |

| 18 | Margaret Thatcher |

| 19 | Adaa Khan |

| 20 | Angela Merkel |

Ranking by number of mentions

| # | Name |

| 1 | Mother |

| 2 | Ngozi Okonjo Iweala |

| 3 | My wife |

| 4 | Oprah Winfrey |

| 5 | Alakija |

| 6 | Chimamanda Adichie |

| 7 | Dora Akunyili |

| 8 | Myself |

| 9 | Queen Elizabeth |

| 10 | Kamala Harris |

| 11 | Michelle Obama |

| 12 | Ibukun Awosika |

| 13 | Beyonce |

| 14 | Angelina Jolie |

| 15 | Omotola Jalade Ekeinde |

| 16 | Senator Natasha Akpoti |

| 17 | Zaha Hadid |

| 18 | Aisha bint Abi Bakr |

| 19 | Ransom Kuti |

| 20 | Aloziye |

Ranking by number of mentions

The world is making good progress towards achieving gender equality. Countries in Africa are taking significant strides in implementing legal changes that promote gender equality. This survey covered some of the challenges and perceptions of gender equality in three African nations. Ultimately, more data covering all populations is required to pinpoint where the real challenges lie and set about improving the situation.

GeoPoll is experienced in conducting research with women in hard-to-reach areas around the globe. If you are looking to conduct research with a female audience in emerging markets, conflict zones, or hard-to-reach areas, please contact us today.

GeoPoll conducted this Rapid Survey through the mobile application mode. The survey targeted random male and female respondents of all ages in Kenya, Ghana and Nigeria the week leading up to International Women’s Day. To learn more about the methodology we used in conducting this survey, and learn about our capabilities in different parts of the world, please contact us.

The post International Women’s Day 2025: Most Admired Women appeared first on GeoPoll.

]]>The post The Gender Equality Report: International Women’s Day 2025 appeared first on GeoPoll.

]]>In line with this theme, GeoPoll conducted a study on gender equality in Ghana, Kenya, and Nigeria during the first week of March 2025. The survey aimed to gather data on public awareness of International Women’s Day, gender equality in education and workplaces, experiences of discrimination and harassment, as well as actions taken to address gender inequality.

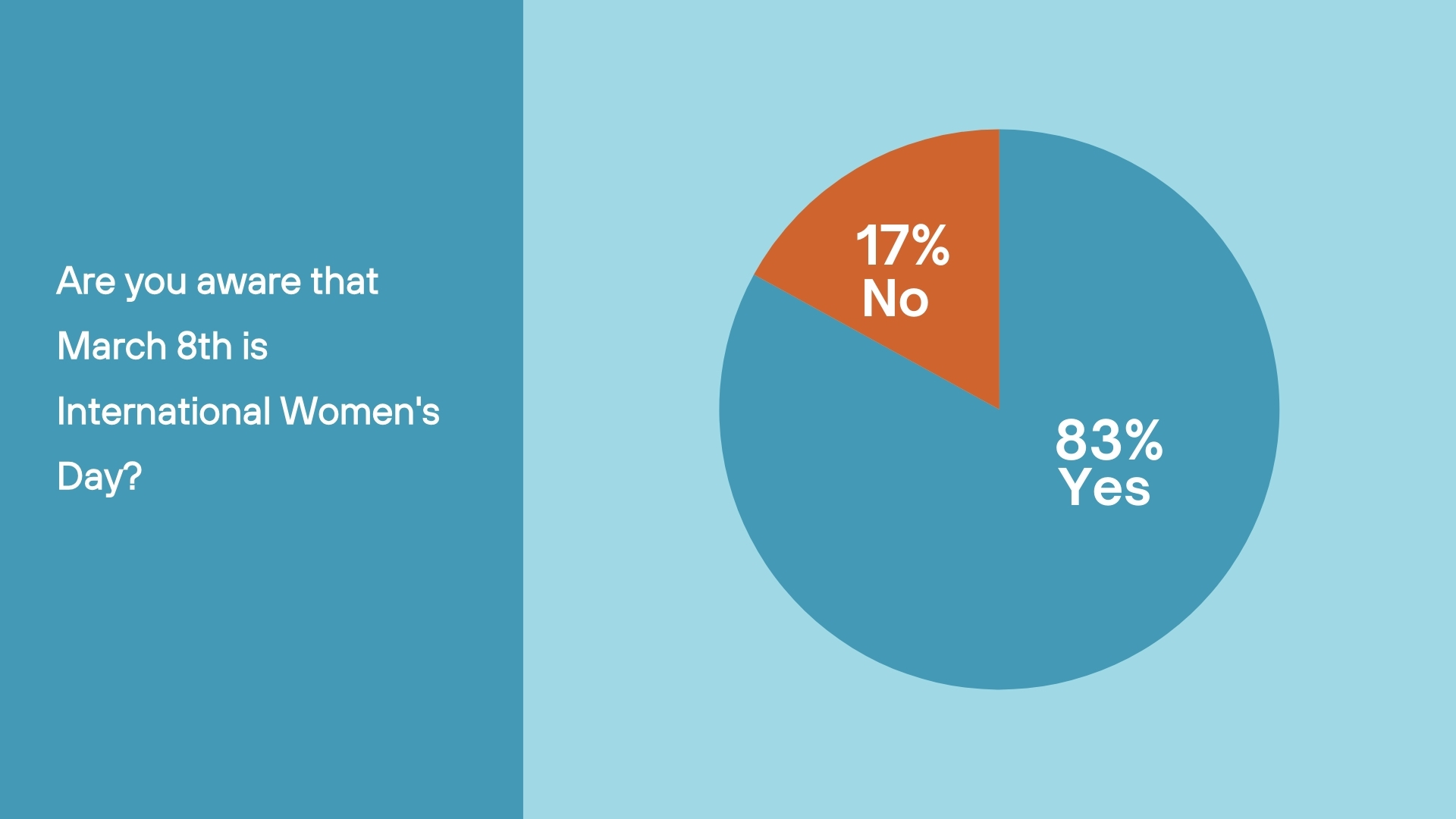

We aimed to assess public awareness of International Women’s Day and how respondents planned to commemorate it. This year, 83% of respondents were aware that March 8th is International Women’s Day, an increase from our similar surveys in previous years. Among those who were aware, many expressed their intentions to support women-led initiatives, mentor young girls, and engage in discussions about gender equality.

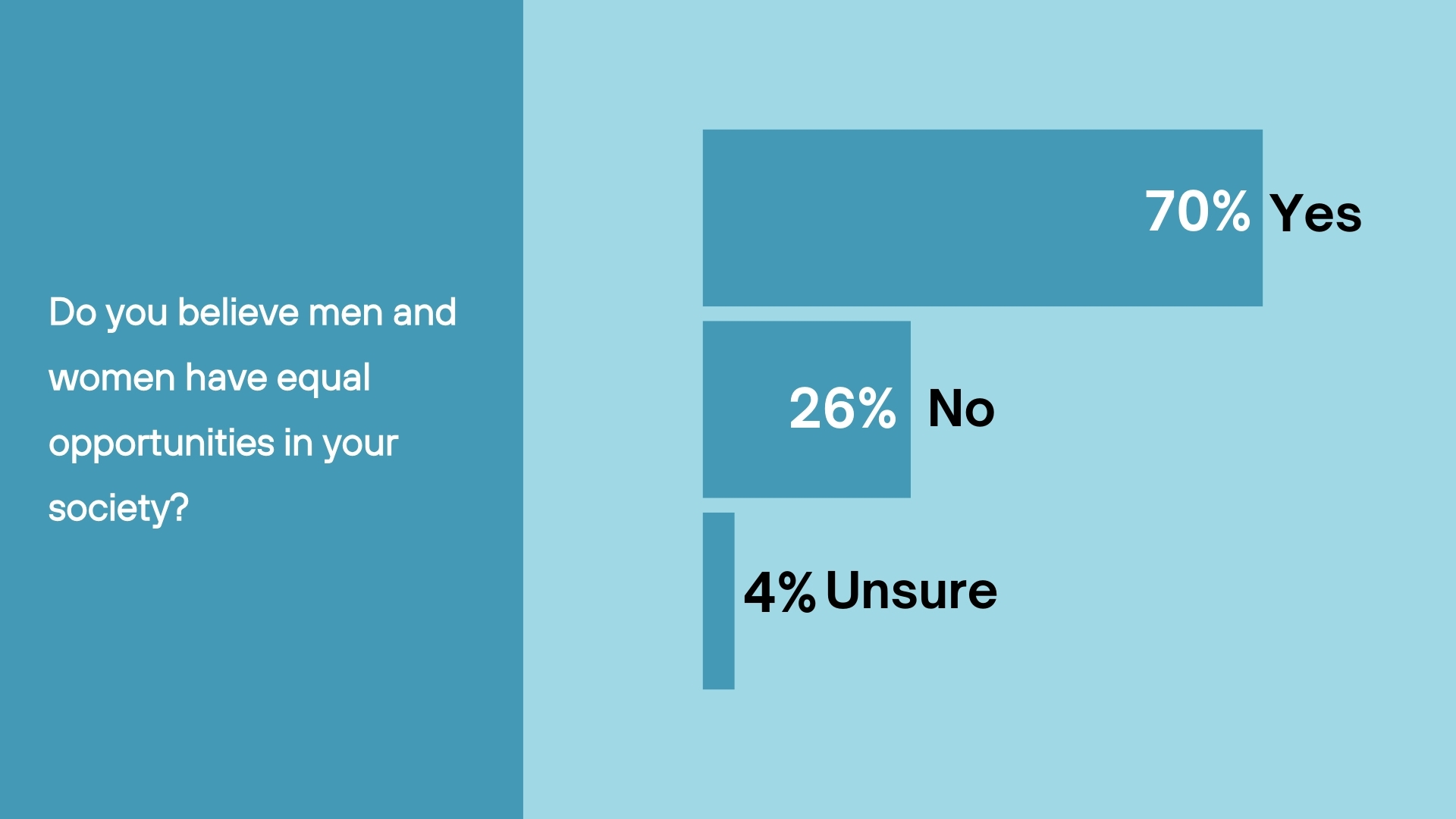

The survey examined perceptions of gender equality in various areas of life. Overall, 70% of respondents believe that men and women have equal opportunities in society, 26% disagreed, and 4% were unsure.

Regarding gender equality in education, 75% of respondents affirmed that boys and girls have equal opportunities to succeed in school. Ghana reported the highest percentage, with 81% agreeing. However, 22% of respondents felt gender disparities still exist in education.

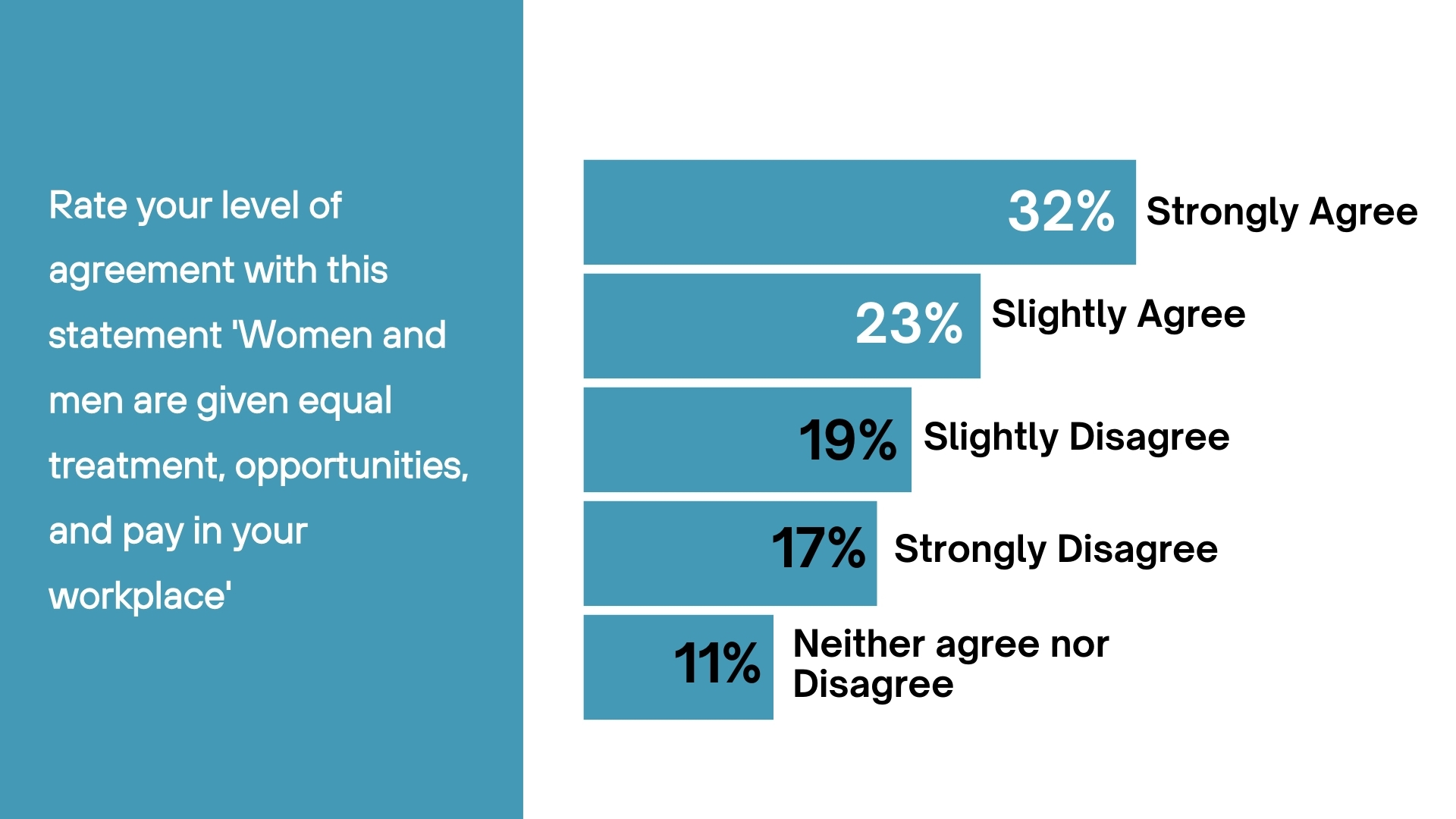

The workplace continues to be a significant area of debate regarding gender equality. This year, 32% of respondents strongly agreed that men and women are treated equally, while 23% slightly agreed. In contrast, 19% slightly disagreed, 17% strongly disagreed, and 11% remained neutral.

When it comes to disparities, promotion opportunities were the main issue: 38% of respondents believed that men are promoted more often than women. In comparison, only 19% felt that women have better chances for promotion. A mere 2% of respondents believed that women earn more than men.

Despite these concerns, there is strong support for equal treatment in the workplace: 69% strongly agreed that men and women should have equal opportunities for pay and advancement.

The survey aimed to uncover perceived gender differences in the workplace. Among the respondents, 29% observed that women receive promotions more frequently, while 25% reported that men are promoted more often. Meanwhile, 22% stated that they had not witnessed any gender-based disparities. Additionally, 15% of participants indicated that men receive higher pay, compared to 6% who believed women are paid more.

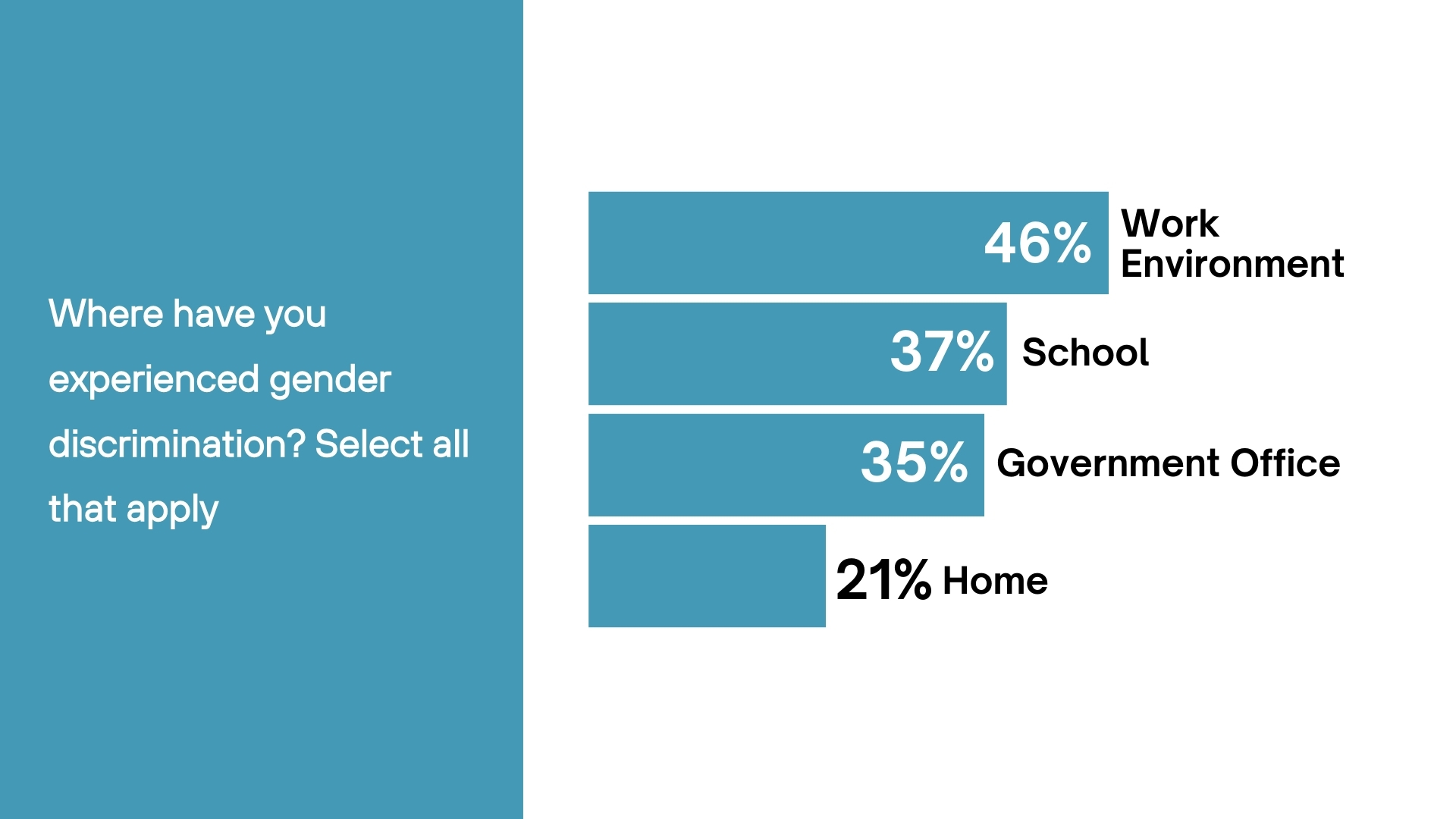

The survey explored the prevalence of gender discrimination and sexual harassment among respondents. This year, it was found that 58% of participants reported having experienced gender discrimination, while 35% indicated they had not, and 7% were uncertain. The survey identified several key areas where discrimination occurred, including:

These findings highlight critical areas of concern regarding gender discrimination in various environments.

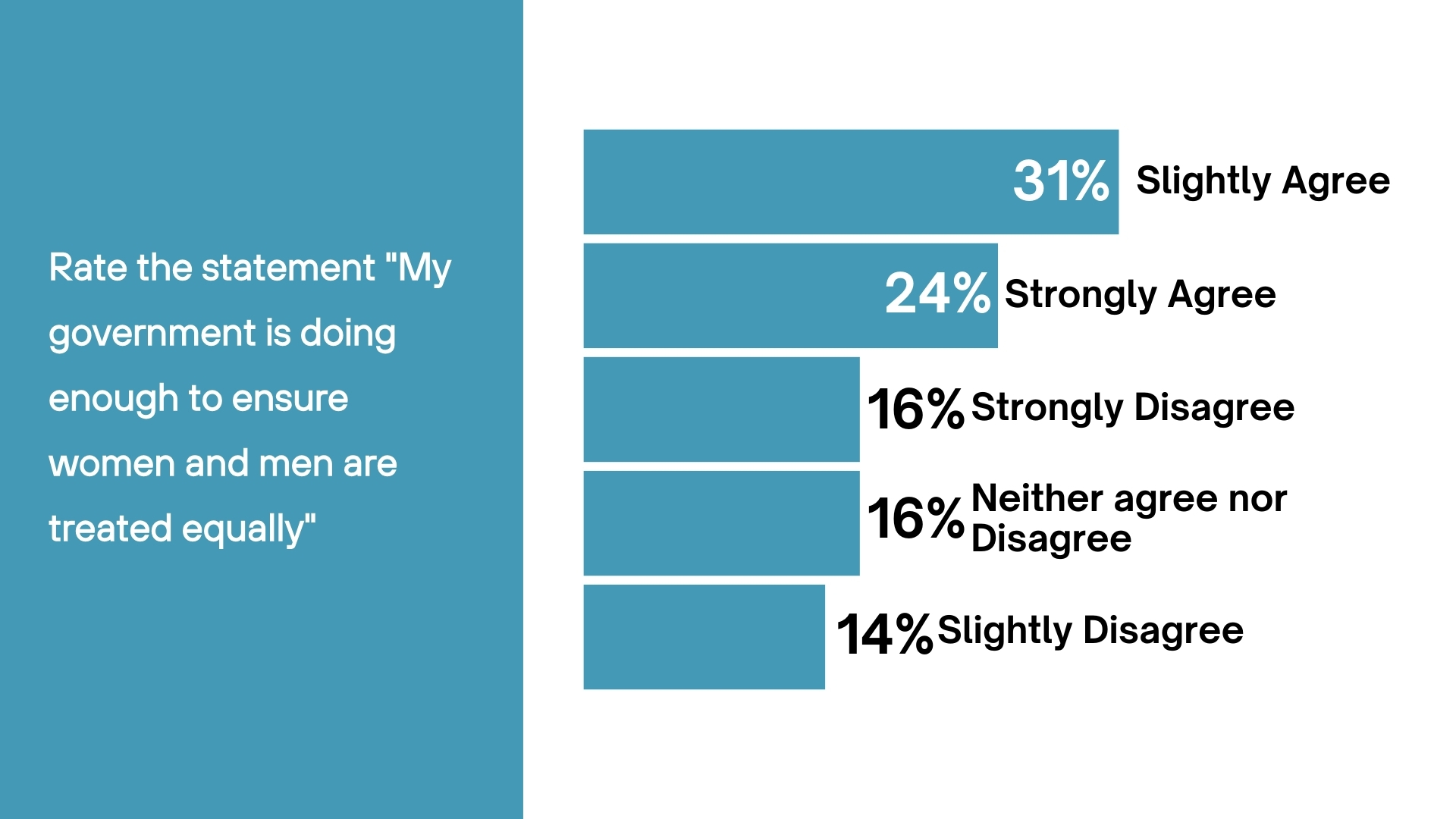

Public opinion regarding government efforts to promote gender equality is mixed. Governments in Ghana, Kenya, and Nigeria have implemented various policies and initiatives aimed at reducing gender disparities. These efforts include programs to increase female representation in leadership, initiatives to address the gender pay gap, and campaigns against gender-based violence.

For example, Kenya has strengthened legal frameworks to protect women from workplace discrimination, while Ghana has introduced initiatives to encourage female entrepreneurship. In Nigeria, the government has expanded policies to support women’s participation in politics and decision-making processes. However, challenges persist, including inconsistent enforcement of these policies and cultural barriers that hinder progress.

When asked if their governments were doing enough to ensure gender equality, the responses were as follows:

Efforts to prevent gender inequality received strong support from survey participants. A significant 55% emphasized that integrating gender equality into training and education is crucial, and an equal percentage advocated for raising awareness on equality. Additionally, 41% recommended the implementation of clear policies on gender, while 38% stressed that everyone should stand up for their rights. The survey also highlighted the need for better gender representation in politics, as noted by 37% of respondents, and 26% urged closing the pay gap between men and women.

Achieving gender equality is a multifaceted effort requiring coordinated actions from governments, businesses, and communities alike. Recent studies emphasize several critical steps to promote gender inclusion. These include the integration of gender equality principles into educational frameworks, the establishment of clear and effective policies, and the enhancement of women’s representation in leadership positions. Focusing on these key areas can help stakeholders create a more equitable society.

GeoPoll conducts surveys globally through mobile-based methodologies, reaching diverse populations efficiently. Our research helps brands, international organizations, and governments gain valuable insights into societal challenges. For more information on our capabilities or to request a quote for an upcoming study, please contact us.

The post The Gender Equality Report: International Women’s Day 2025 appeared first on GeoPoll.

]]>The post Understanding Kenyans’ Perception of the Social Health Authority (SHA) and Social Health Insurance Fund (SHIF) appeared first on GeoPoll.

]]>The Social Health Authority (SHA) is the government agency established to oversee and regulate Kenya’s new healthcare financing system. It replaces the National Health Insurance Fund (NHIF) and is responsible for managing the new health insurance structure under the Social Health Insurance Fund (SHIF). Employers were required to register their employees and their dependents with SHA through the SHA Employer Portal by October 1, 2024. The final date for NHIF admissions was September 30, 2024.

The Social Health Insurance Fund (SHIF) is the primary health insurance scheme under SHA. It is designed to ensure that all Kenyans, including those in the informal sector and vulnerable groups, have access to affordable and quality healthcare.

To better understand the public perception of Kenya’s new healthcare reforms, GeoPoll recently conducted a survey on SHA /SHIF. The study sought to assess awareness, understanding, and attitudes toward these initiatives, which are set to replace the National Health Insurance Fund (NHIF) as part of the government’s Universal Health Coverage (UHC) strategy.

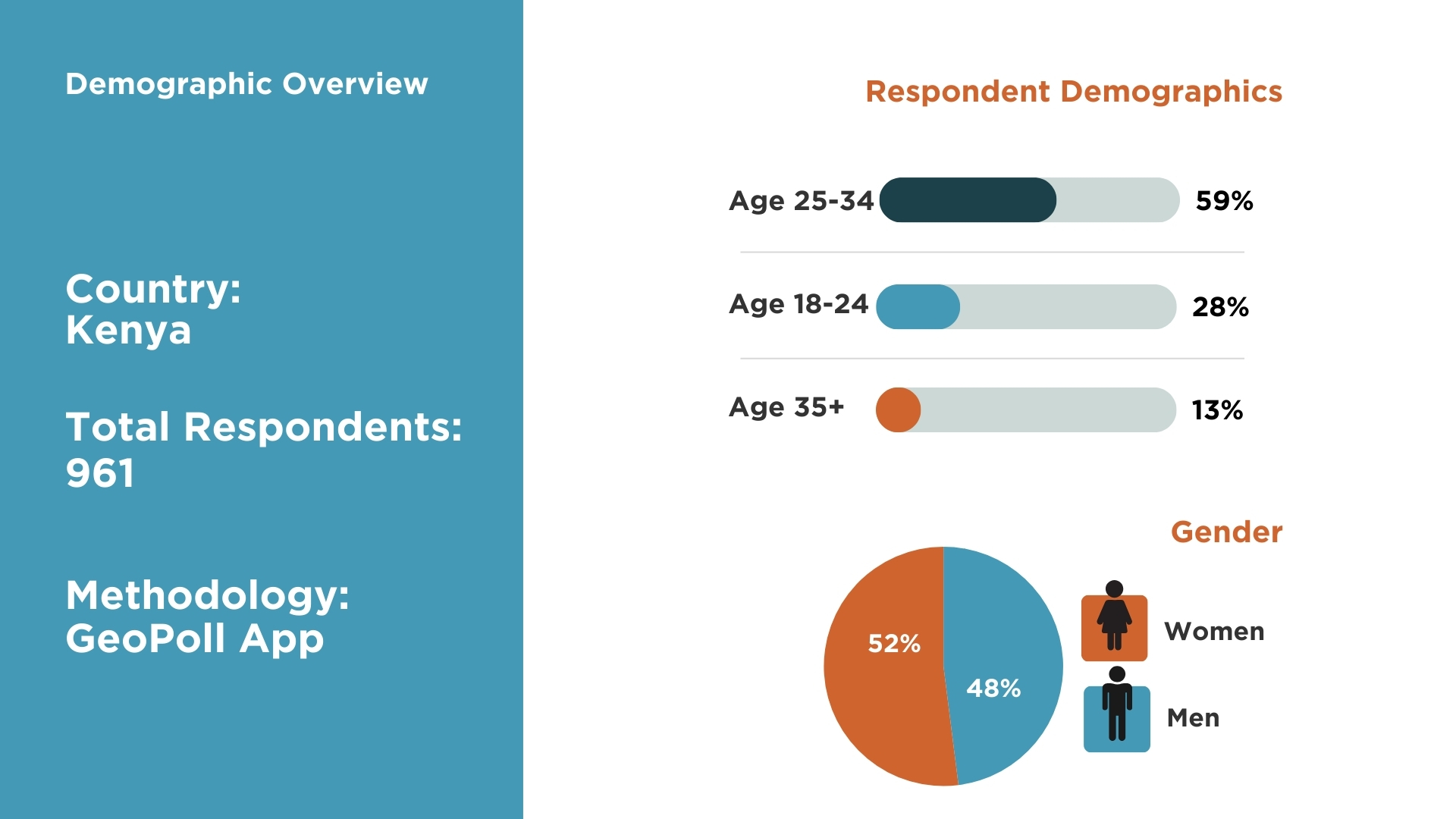

The survey gathered feedback from 961 respondents in Kenya. The participants are of age 18 years old and above, with the largest share being between 25-35 years old (59%), and comprised 52% female and 48% male. A majority, (38%) are college degree holders. In addition, 73% stated that they reside in urban areas whereas 27% live in rural areas.

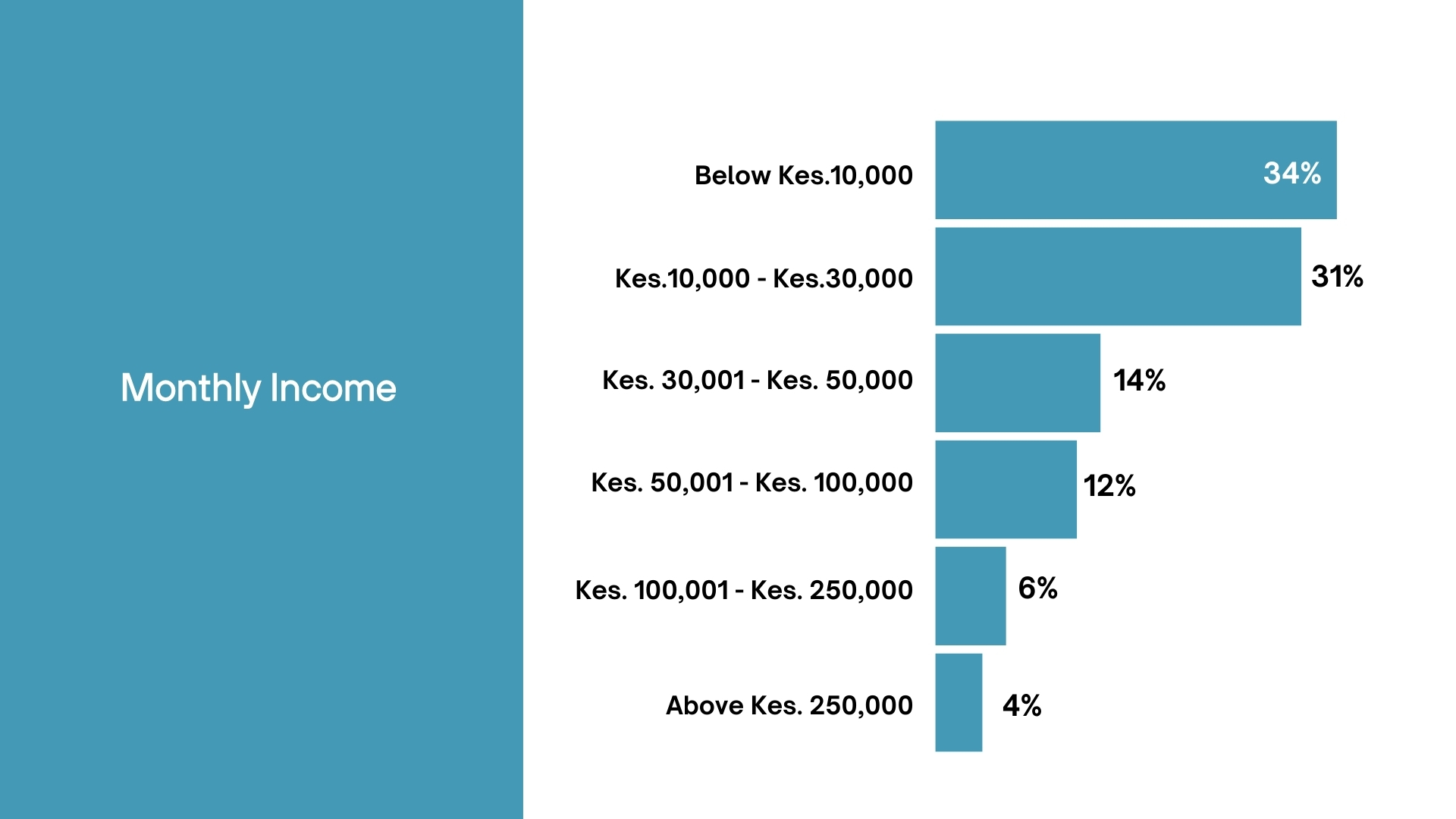

The survey results indicated that a significant portion of respondents (34%) earn less than Kes. 10,000, followed closely by 31% who fall within the Kes. 10,001 – Kes. 30,000 income bracket. Additionally, 14% earn between Kes. 30,001 and Kes. 50,000, while 12% report earnings of Kes. 50,001 – Kes. 100,000. A smaller percentage, 7%, earn between Kes. 100,001 and Kes. 250,000, with only 4% making more than Kes. 250,000.

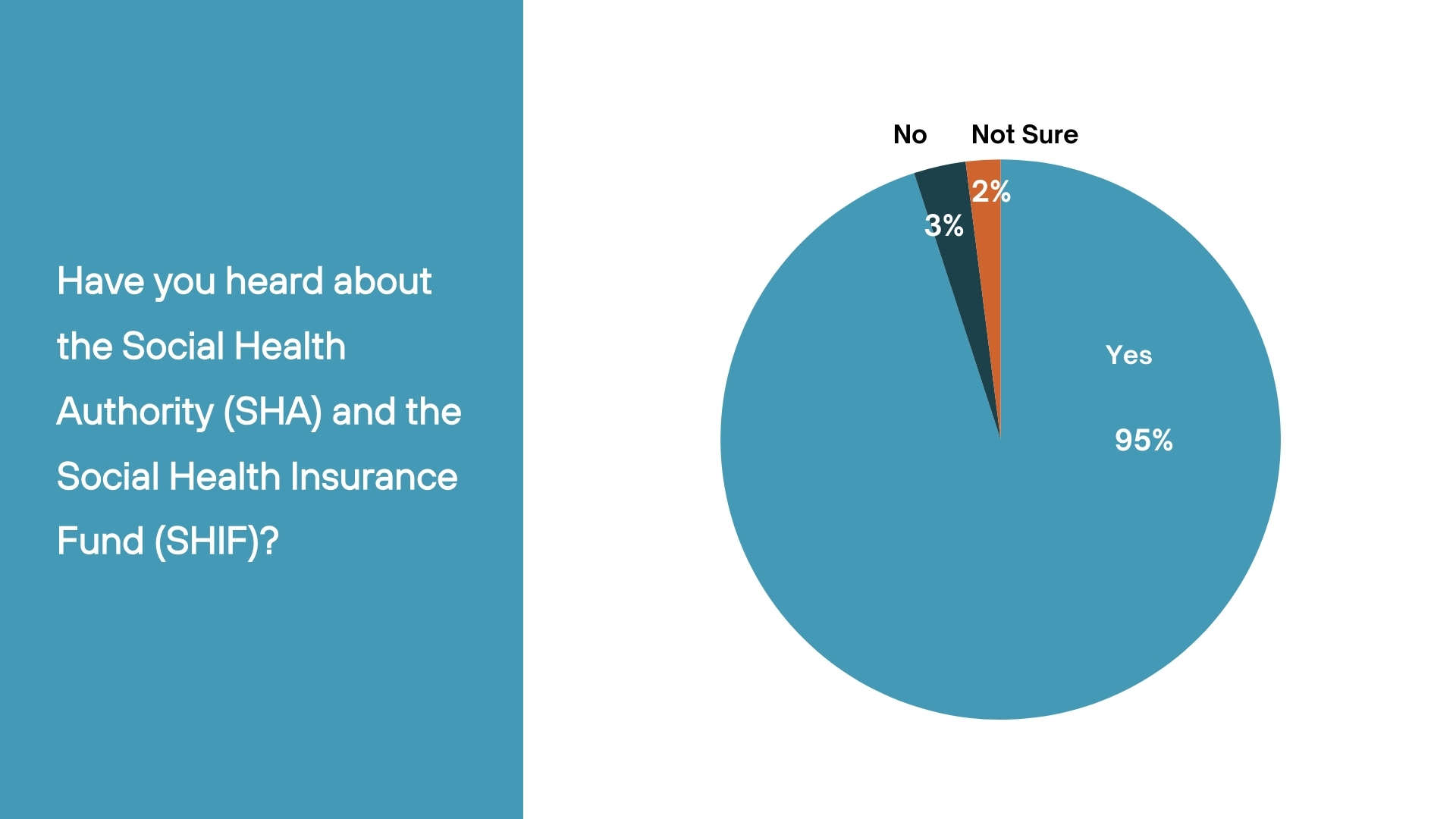

Our survey showed that 95% of respondents are aware of SHA and SHIF, while 4% have never heard of them. Among those who are familiar with SHA and SHIF, 34% have extensive knowledge, 33% have some knowledge, 26% have limited knowledge, and 4% have no knowledge at all.

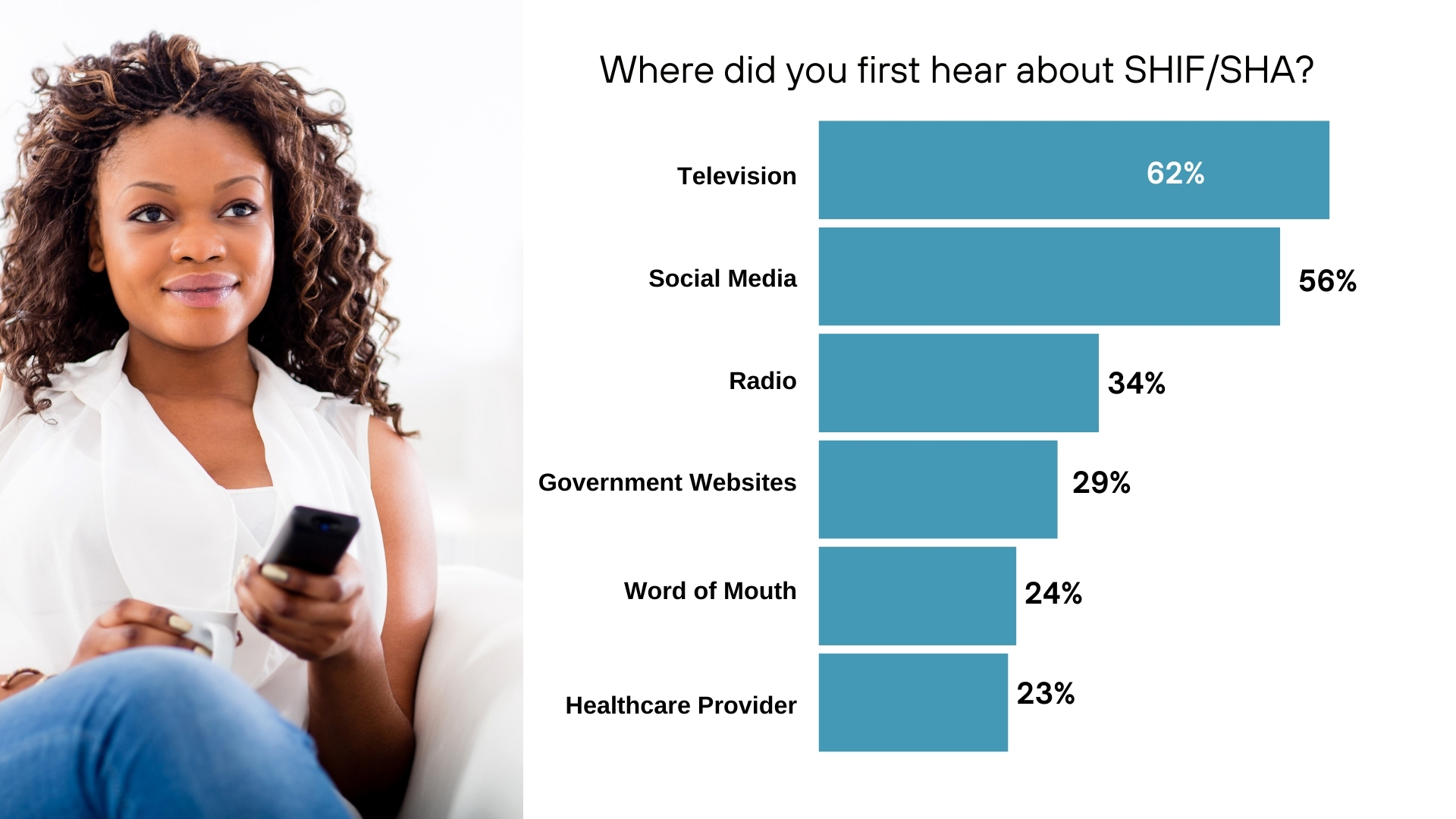

Television is the primary source of information for respondents, with 27% indicating that they rely on it for updates about SHA and SHIF. Social media follows closely behind as the main source of information for 25% of participants. Radio is also a significant channel, with 15% of respondents learning about SHA and SHIF through it. Furthermore, 13% of participants reported obtaining information from official government websites. Word of mouth is another important source, with 10% of respondents hearing about SHA and SHIF through informal conversations, while healthcare providers, such as doctors and nurses, are influential sources for another 10% of participants.

This distribution highlights a diverse mix of traditional and digital communication channels that contribute to public awareness of SHA and SHIF.

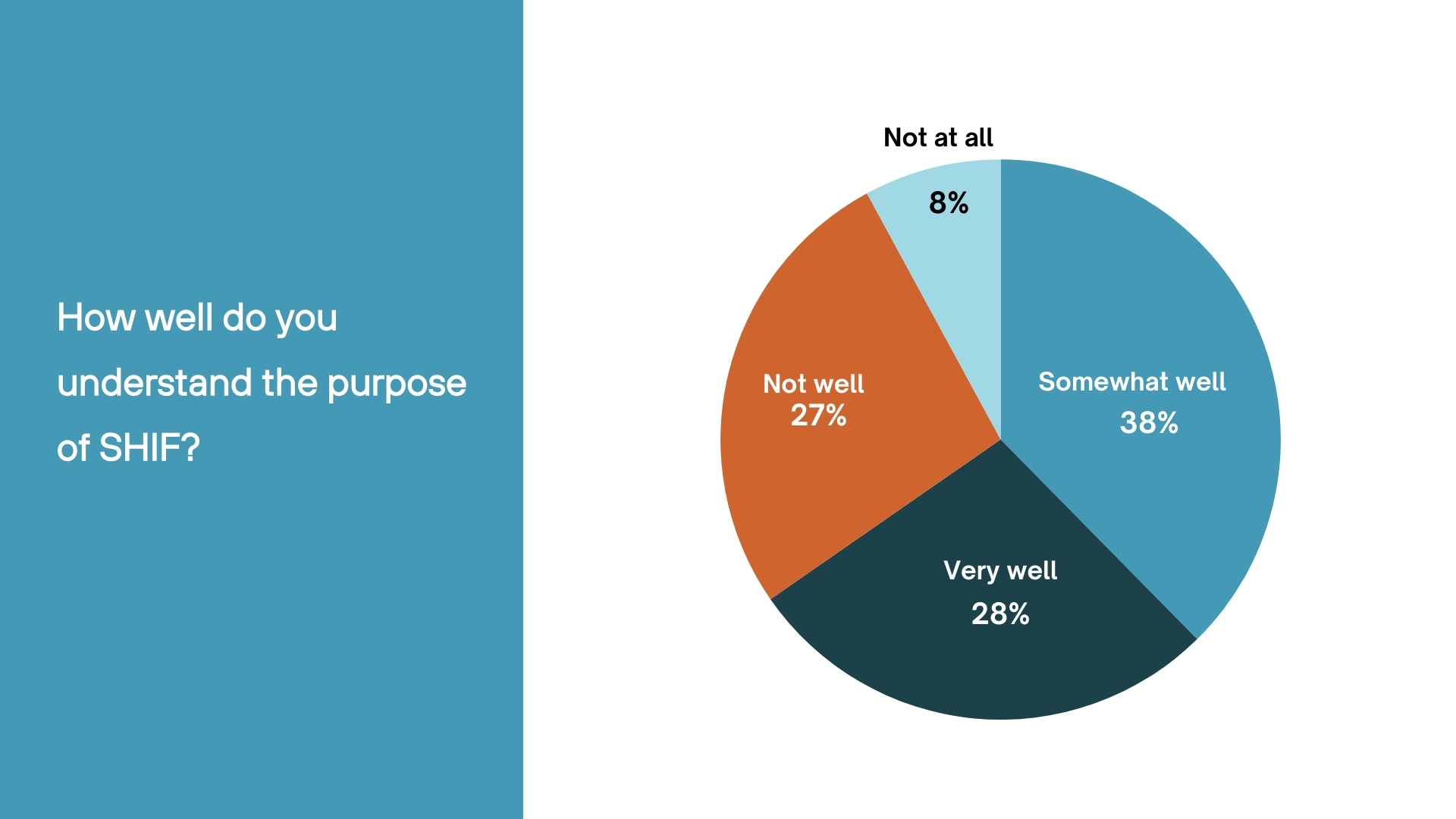

A significant portion of respondents, 38%, indicated that they have a somewhat good understanding of SHIF. This suggests that while they are familiar with the concept, they may not fully grasp all its details and nuances. Additionally, 27% reported having a very good understanding of SHIF, indicating that they are highly knowledgeable about how the fund works, its benefits, and its role in the healthcare system.

On the other hand, 27% of respondents acknowledged having a limited understanding of SHIF. This could indicate a lack of clear or detailed information, or possibly confusion regarding its functions and services. Additionally, an 8% minority stated that they do not understand SHIF at all, highlighting a significant gap in knowledge or awareness. This gap could result from factors such as limited access to information or communication barriers.

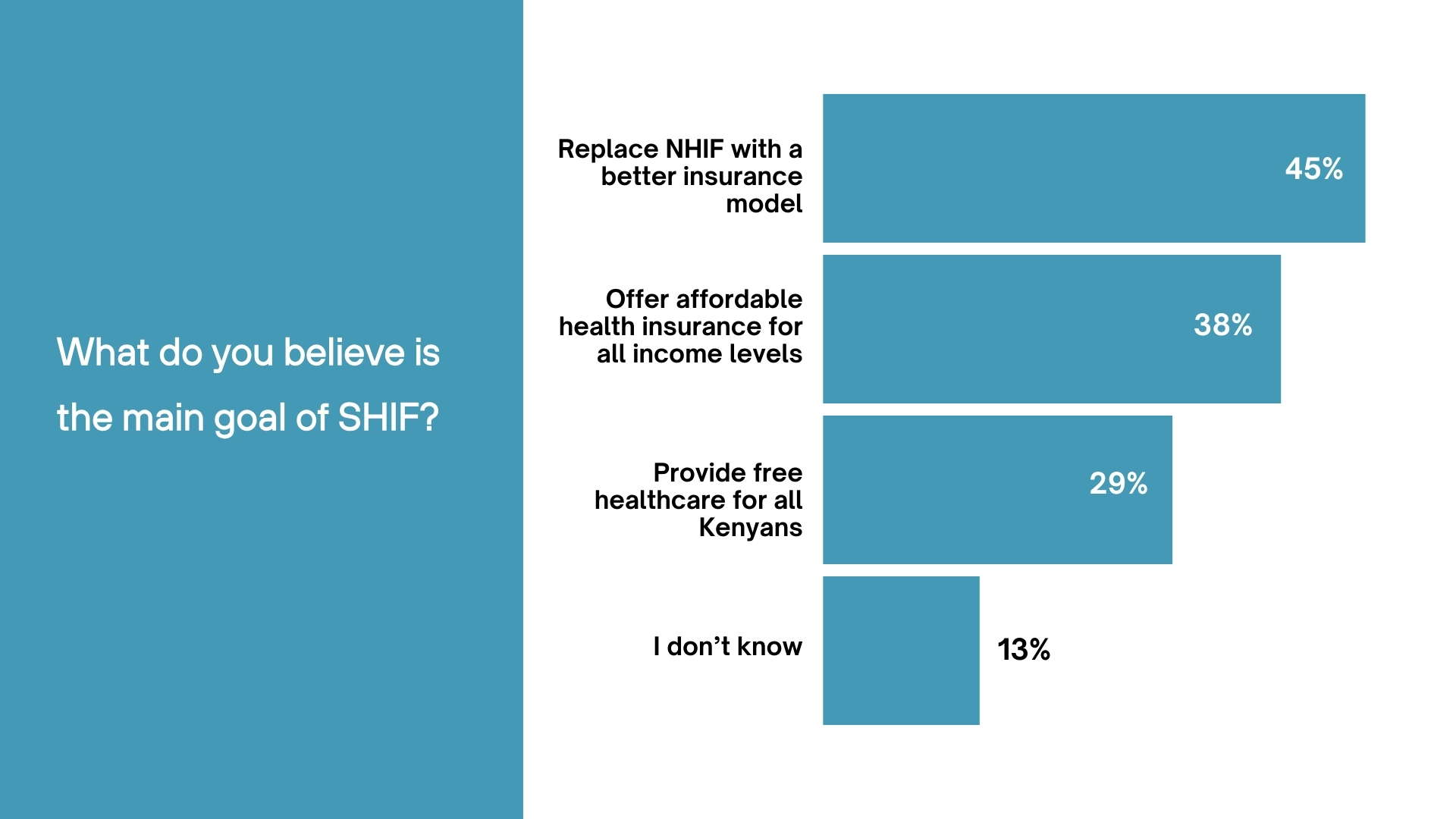

The survey revealed diverse perceptions about the purpose of SHIF. A significant 35% of respondents believe that SHIF is meant to replace NHIF with a more effective and improved insurance model. Meanwhile, 28% view SHIF as a way to provide affordable health insurance for individuals across all income levels. Additionally, 22% of participants see SHIF as a program designed to offer free healthcare to all Kenyans. However, 10% of respondents were unsure about SHIF’s specific goals, indicating a gap in awareness or understanding.

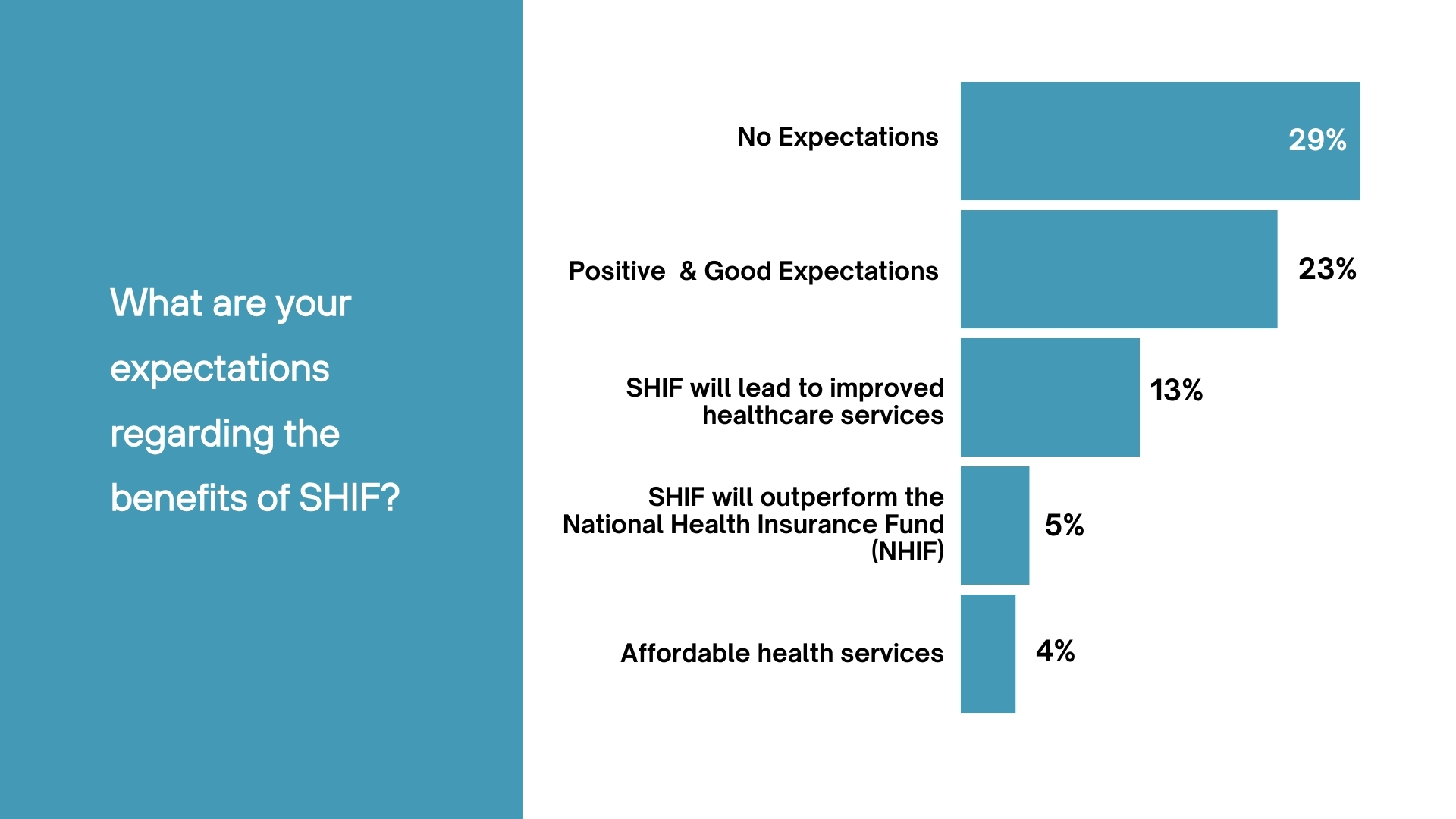

In this survey, we aimed to understand the participants’ expectations regarding the Social Health Insurance Fund (SHIF). The majority of respondents, 29%, indicated that they have no specific expectations for SHIF. Close behind, 23% expressed positive expectations, showing a hopeful outlook for the fund’s future impact.

Additionally, 13% of respondents are optimistic that SHIF will lead to improved healthcare services, indicating a desire for better quality and more accessible healthcare options. A smaller group, 5%, expects SHIF to outperform the National Health Insurance Fund (NHIF), suggesting a wish for enhanced benefits or increased efficiency. Finally, 4% of participants emphasized the importance of affordability, expressing hope that SHIF will provide health coverage that is financially accessible to a broader population.

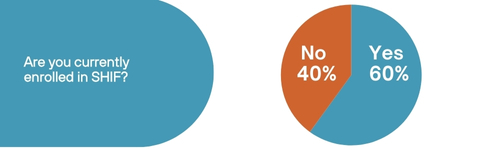

According to the survey, 60% of the participants have registered for the Social Health Insurance Fund (SHIF), while 40% have not completed their registration.

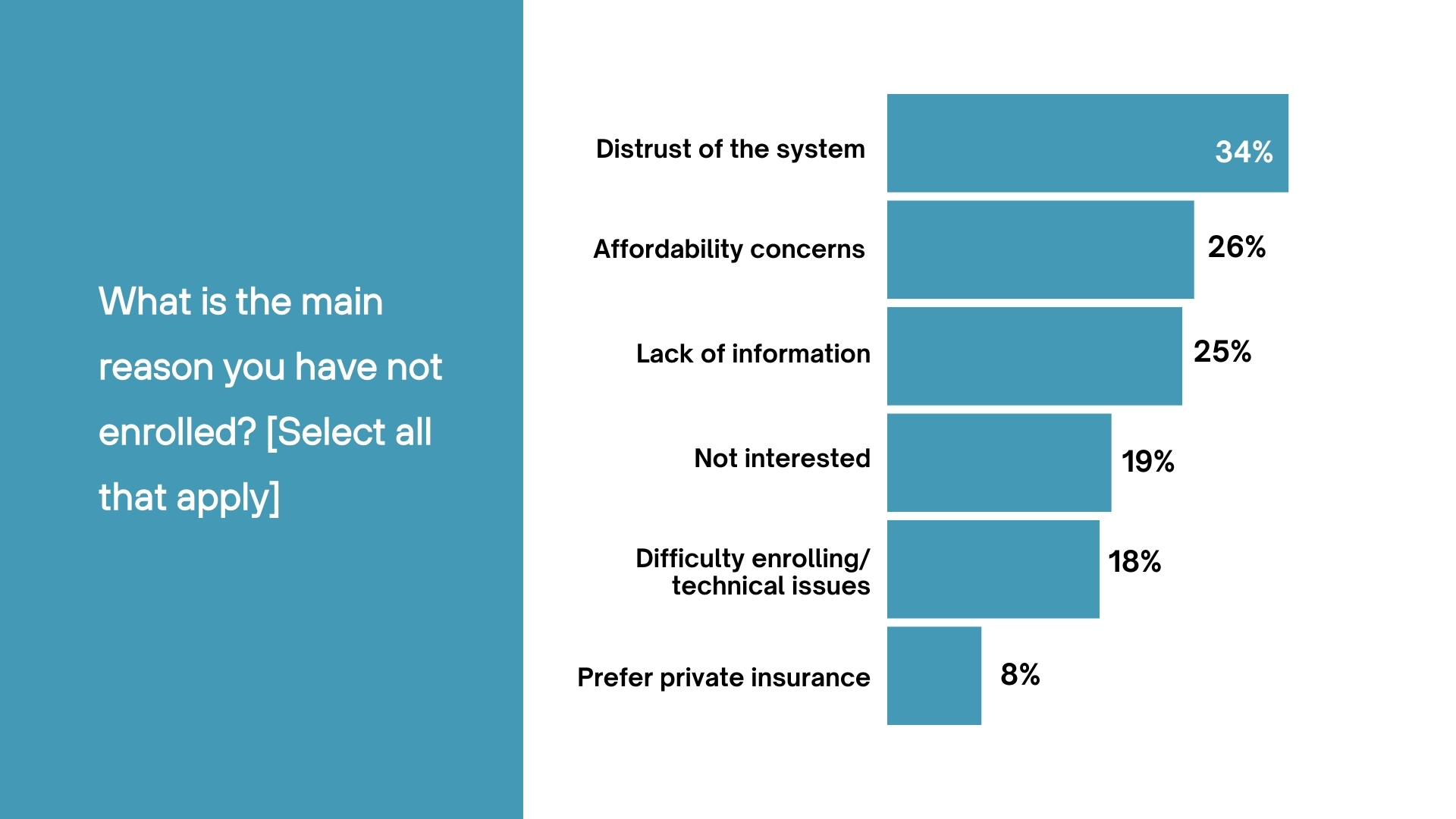

Among those who have not registered for the Social Health Insurance Fund (SHIF), 34% cited a lack of trust in the system as their primary reason for not enrolling. Additionally, 26% expressed concerns about affordability. Furthermore, 25% mentioned that insufficient information was a barrier to registration, while 19% stated a simple lack of interest. Some respondents (18%) reported facing difficulties during the enrollment process, and 9% preferred private insurance options over SHIF.

Of those enrolled in the Social Health Insurance Fund (SHIF), 63% reported that they have not yet utilized their SHIF coverage, on the other hand, 37% have accessed the new insurance services.

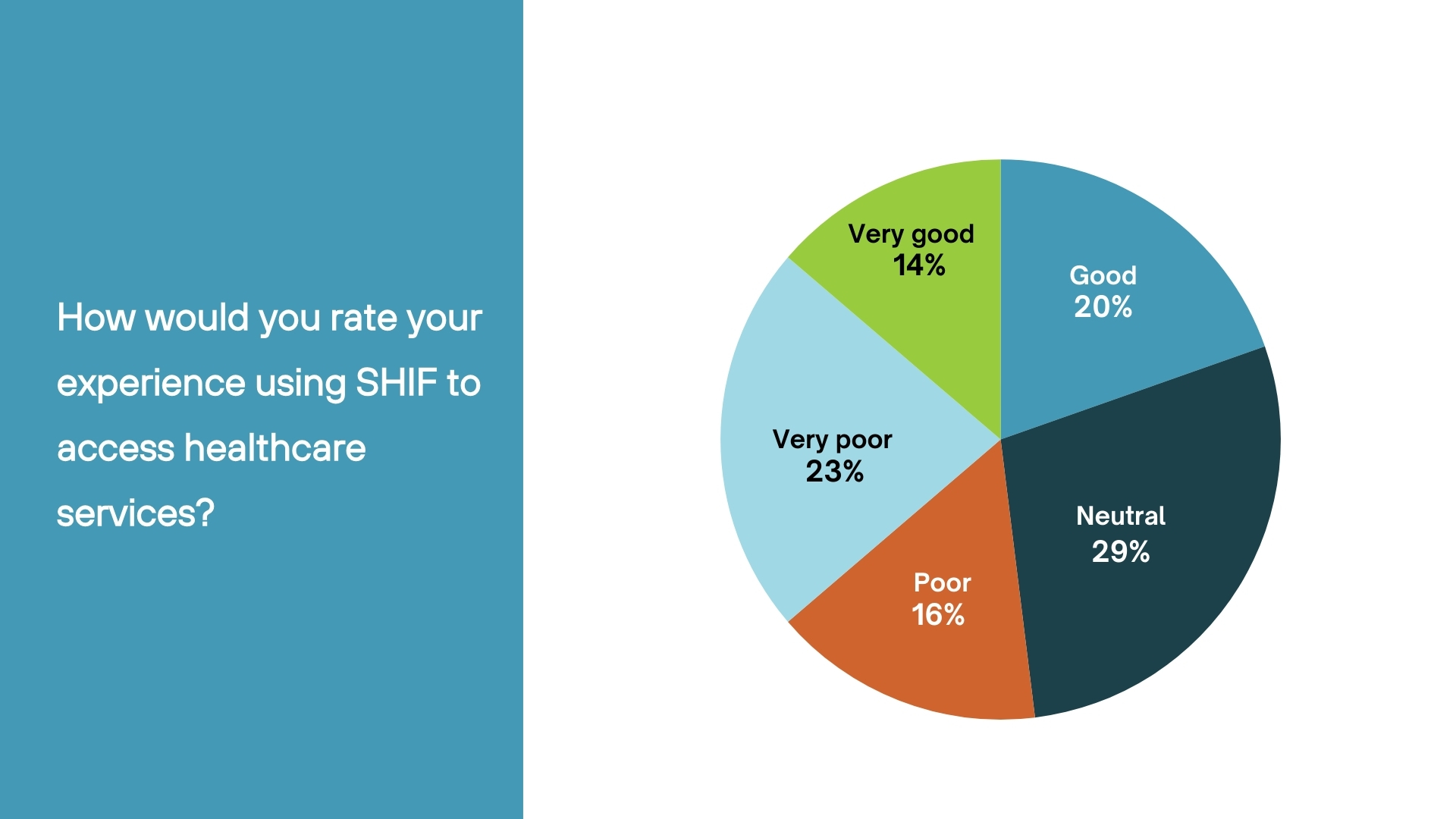

Of those who have used SHIF, the feedback on their experience varies. A notable 29% expressed a neutral experience, indicating neither satisfaction nor dissatisfaction with the services provided. Meanwhile, 23% reported a very poor experience, highlighting concerns or dissatisfaction with the healthcare services or benefits they received.

In contrast, 20% of users shared that their experience was good, suggesting that a portion of enrollees felt their expectations were met. 16% rated their experience as poor, pointing to areas of improvement needed. However, 14% of respondents indicated that their experience with SHIF was very good, reflecting a positive outlook and satisfaction with the services provided.

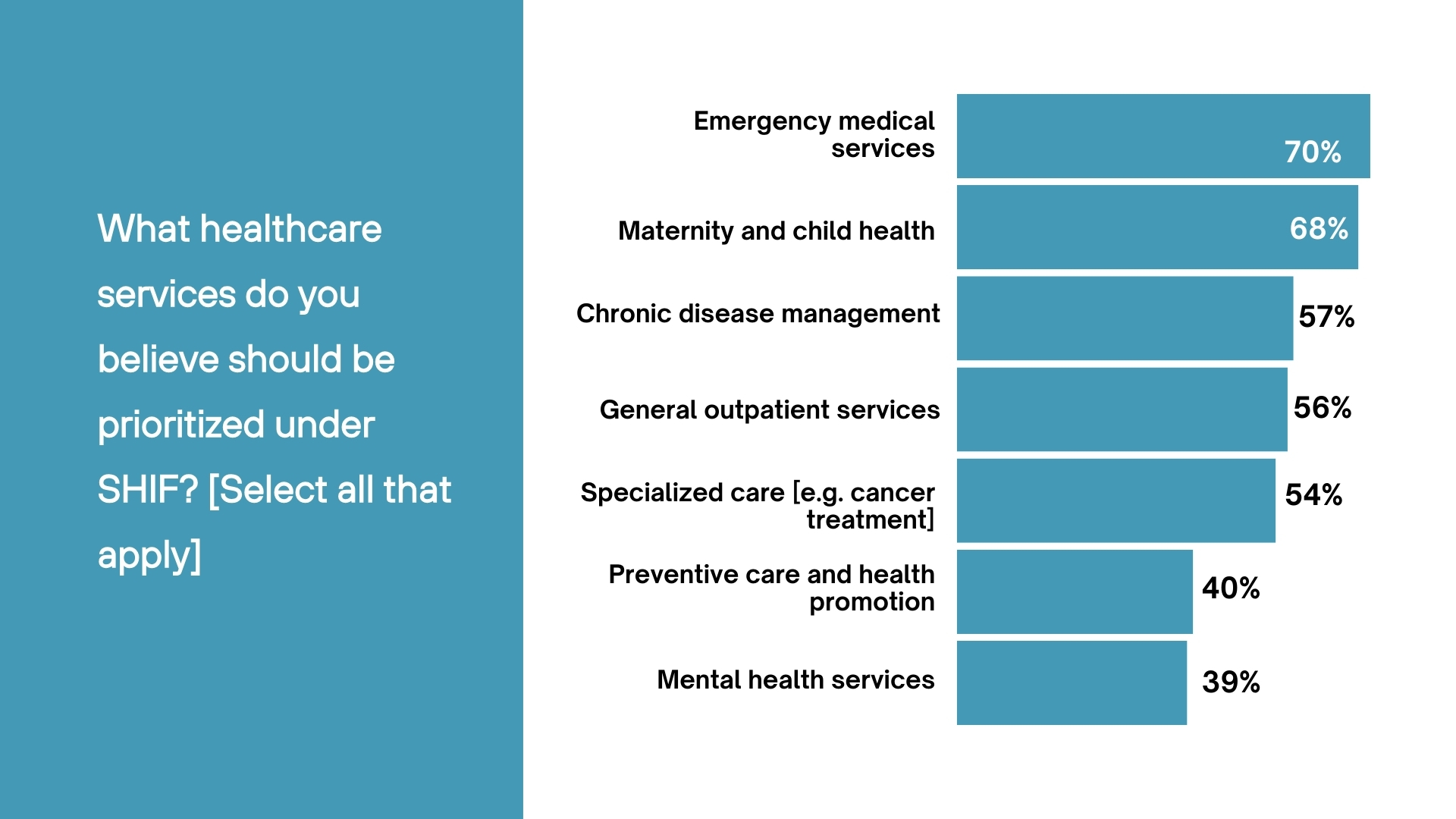

Survey participants identified several healthcare services that should be prioritized under the Social Health Insurance Fund (SHIF). The highest priority was given to emergency medical services, which 70% of respondents highlighted as essential. Following closely were maternity and child health services, valued by 68% of participants. Additionally, 57% emphasized the need for improved management of chronic diseases. General outpatient services and specialized care, such as cancer treatment, were deemed essential by 56% and 54% of respondents, respectively. Furthermore, 40% of participants stressed the importance of preventive care and health promotion, while 39% called for a greater focus on mental health services.

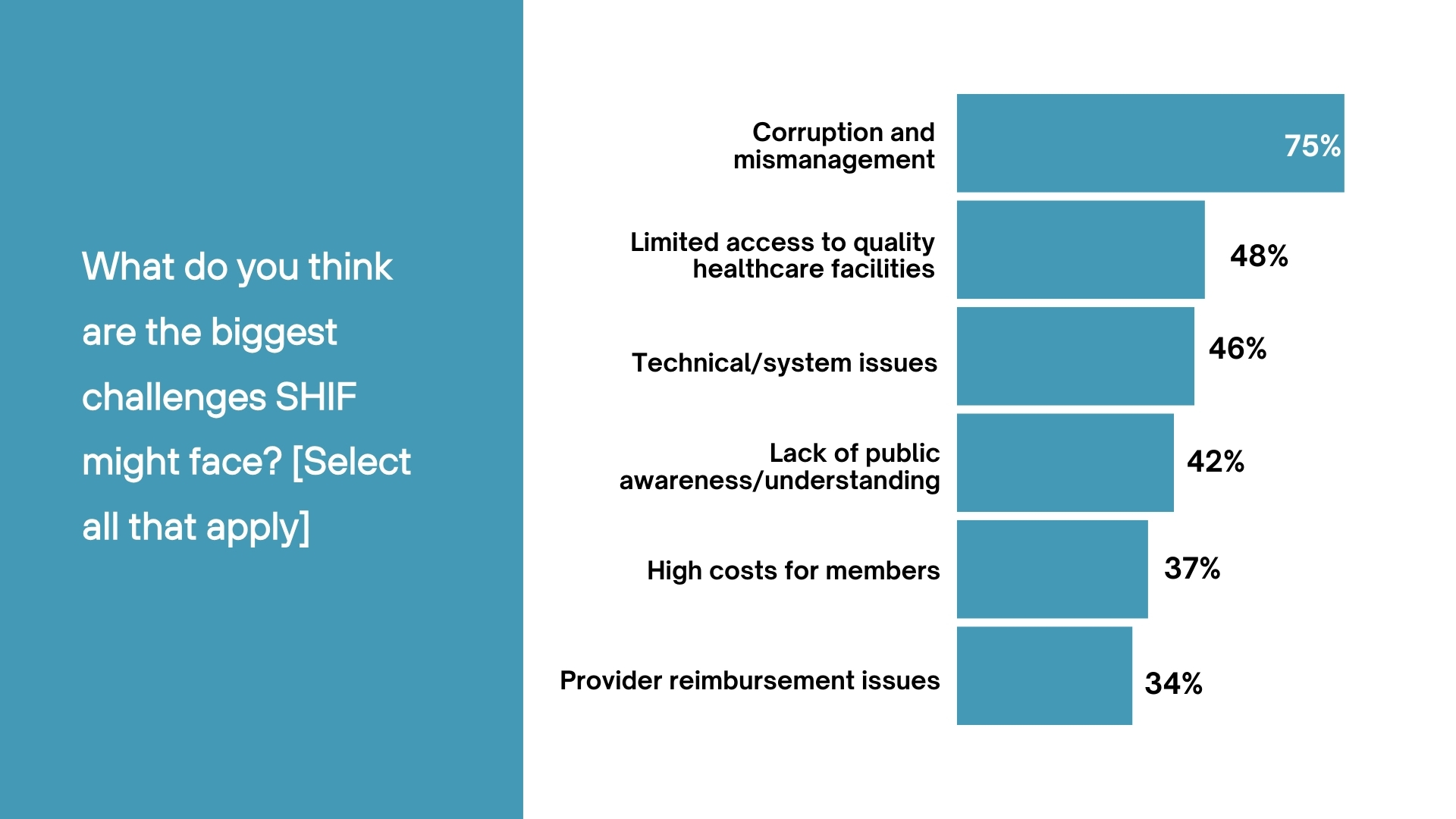

The survey identified several key challenges faced by the Social Health Insurance Fund (SHIF). The most significant issue was corruption and mismanagement, which affected 75% of respondents. Limited access to quality healthcare facilities was a major concern for 48% of participants. Additionally, technical and system issues were highlighted by 46% of respondents, while 42% noted a lack of public awareness about SHIF. High costs for members were a worry for 37% of those surveyed, and 34% cited provider reimbursement issues as a significant challenge that disrupts service delivery and overall effectiveness.

This Exclusive Survey was run via the GeoPoll mobile application between the 20th February and 26th of February 2025 in Kenya. The sample size was 961, composed of random GeoPoll app users above the age of 18. Since the survey was randomly distributed, the results are slightly skewed towards younger respondents.

GeoPoll is committed to supporting health organizations, NGOs, and governments in future health challenges. Together, we can use data to inform targeted interventions, mitigate the impact of public health crises, and build more resilient health systems for the future. Our mobile-based surveys offer a unique and tried-and-tested way to gather insights on disease spread, public perception, and vaccine hesitancy, especially in under-resourced regions.

Please get in touch with us to get more details about our capabilities, explore more on healthcare, or other topics in Africa, Asia, and Latin America.

The post Understanding Kenyans’ Perception of the Social Health Authority (SHA) and Social Health Insurance Fund (SHIF) appeared first on GeoPoll.

]]>The post The Power of Mobile-Based Research in Tracking Migration appeared first on GeoPoll.

]]>Traditional migration studies – in-person surveys or censuses – often fail to capture timely insights, especially for mobile or hard-to-reach populations. Mobile-based data collection is changing the game by enabling real-time, large-scale insights into migration trends. As in the example above where GeoPoll ran the multicountry Central America survey via phone calls (CATI), mobile surveys (via SMS, voice calls, or mobile web), enable researchers to quickly reach respondents across wide geographies, including migrants on the move or remote communities. This approach offers several advantages over traditional methods:

Mobile-based migration research is not just theoretical – it’s already being used in the field. For example, the UN World Food Programme’s mVAM project successfully used phone surveys at scale to monitor refugee populations, a further proof to this method’s effectiveness in humanitarian settings.

Understanding migration patterns and drivers has real implications for policy and aid. Effective policies hinge on accurate, up-to-date data about migration flows. Knowing where, why, and how people move is essential for designing interventions that balance the needs of migrants with those of origin and destination communities. Data-driven insights help stakeholders in several ways:

High-quality migration data is critical for designing and evaluating policies that yield economic, social, and humanitarian benefits. With solid evidence in hand, decision-makers can create targeted solutions – from job programs to address economic drivers, to security initiatives that curb violence, to improved aid plans for refugees. In short, data-driven migration research enables governments and organizations to move beyond guesswork and respond with informed strategies.

As migration challenges change, so must our methods of understanding them, and embracing mobile-based research allows us to capture trends as they unfold and craft more responsive policies. Governments and organizations have much to gain by adopting data-driven approaches – from designing better job opportunities at home to providing timely support for refugees abroad.

In an interconnected world, leveraging real-time data is an advantage and a necessity for managing and providing a more proactive response to migration. Data-driven research should be a cornerstone of how we tackle migration issues, ensuring that policies are guided by migrants’ actual needs and motivations.

GeoPoll has been at the forefront of mobile-based migration research, pioneering innovative methods to collect data from populations that traditional surveys often miss. With experience administering remote surveys in over 120 countries, GeoPoll partners with governments, development agencies, and NGOs to gather reliable data on several social issues, including migration trends. We can deploy questionnaires via SMS, voice (CATI), and mobile web, and rapidly collect feedback from dispersed communities, with near real-time insights. Looking ahead, mobile surveys can be expanded for even deeper insights – from longitudinal studies tracking migrants’ outcomes over time, to quick polls gauging public perceptions of new immigration policies across countries.

To learn more about our capabilities and coverage, please contact us.

The post The Power of Mobile-Based Research in Tracking Migration appeared first on GeoPoll.

]]>The post Donna-lee Ginsberg on Conducting Research in LATAM appeared first on GeoPoll.

]]>

Thank you! It’s so great to be here. Sometimes it feels like I was born a researcher! I’ve always been curious. Curiously understanding myself, the world, the people around me and, I’ve always been a bit of a math-nerd and felt very comfortable around and working with numbers, especially creatively. I didn’t study research—I completed my honors in Economics (and I’m still highly motivated and passionate about Economics). But, of course, Economics and the analysis thereof requires a lot of research, data, critical thinking and understanding, so my degree and my passions helped me land my first job as a Research Executive at Nielsen. That’s where I fell deeply in love with data and its power to guide and transform not only countries economically but company strategies and decisions—helping businesses best meet their customers’ needs by understanding people – all through using numbers creatively – what a dream.

Research and thoughtful data-driven deduction – I truly fell in love with this recipe.

I was lucky enough to work with and for Unilever for a big part of the first half of my career—where the customer is at the heart of everything. My passion for data, customer research, and the symbiosis of retail and marketing was deeply influenced by my time at Unilever, where I spent my time facilitating the partnership between data, marketing, and customer teams. My curiosity grew further when I began to explore research beyond the realm of pure retail measurement when I joined TNS, where I developed skills that tapped into the subtle, more qualitative side of understanding the customer. There are so many behaviors pure purchasing data would never uncover because so much of what we do as human beings is subconscious. Even our likes and dislikes are often deeply rooted in our subconscious, making them nearly impossible to articulate consciously. After being exposed to beautiful and brilliant qualitative techniques and methods that allow researchers to ask the question without asking the question—I saw how we could even better serve customers – beyond data. Not just in what we offer them but in how we communicate, communication after all is everything. You can have a policy, an idea, a business, a message, a product – but if you don’t know how to communicate it clearly and meaningfully to the right people.

The dream is lost and what a shame.

I eventually found myself at Mr. Price—the largest and most prolific fashion retailer in South Africa. A true honor to work for another exceptionally dynamic and creative business that puts its customers first, proving that this approach consistently delivers excellent business results. Then in 2021 after a very turbulent period in my personal life – losing both of my parents unexpectedly within the space of 11 months – I needed to move on, both in my career and geographically and quite spontaneously (and courageously!) moved to Panama, Central America. Around that time, I started working with Meta on their B2B business, further developing my qualitative research skills—but this time, in the B2B space, where the business is the customer. It was fascinating. At Meta, the focus wasn’t on asking the “right” questions—because there are no right questions—but on continuously asking more questions. I learned how to qualitatively assess business sentiment and decision-making processes in the tech space, working with some of the most truly brilliant minds and topics like Privacy, Integrity, Artificial Intelligence and their perception and adoption among businesses.

GeoPoll had been on my radar since my Unilever days as a research company that was truly innovative and agile from the very beginning. The piloting of mobile data collection in Africa always left me in awe – GeoPoll was meeting people where they are at and at scale! This was a company operating at the intersection of technology, human and international development, and agile insights for business growth across all demographics – all very early in the game.

Coming from South Africa and working in research, I was acutely aware of how difficult it was to reach certain demographics—especially quantitatively. So when GeoPoll took off, I thought, well, that’s a smart business! I had always admired how GeoPoll leveraged mobile research to fill a crucial gap in data collection, particularly in emerging markets where traditional methodologies often fall short.

I was also now ready for a role that aligned with my passion for emerging markets, agile research, and large-scale data-driven impact. GeoPoll was a perfect fit—combining my experience in both quantitative and qualitative methodologies with my desire to work on projects that influence real-world decisions across LATAM (where I now live), Africa (where I am from) and a business that leads by innovation, it was a no-brainer.

What excites me most about my role at GeoPoll is being part of a company where my voice is heard, my opinions matter, and I can directly shape the work we do. It’s incredibly fulfilling to know that at GeoPoll isn’t just about numbers and insights—it has the power to make a real difference in the world from the inside out. Whether it’s helping brands better understand their consumers, supporting humanitarian efforts, or informing policy decisions, the impact is tangible, and we are committed to doing this smarter, faster and with more impact every day. Being in a space where I can contribute meaningfully, collaborate with brilliant minds, and be part of something that truly matters—that’s what makes my role at GeoPoll deeply rewarding.

The Global South is largely misunderstood in many ways, and I believe LATAM even more so. Being part of the “Americas,” yet fundamentally different from North America, it’s a disservice to lump LATAM into the same frameworks we use to understand and serve North America—or even Africa and Asia.

In my four years living in Panama, I’ve seen many similarities between LATAM and Africa. But I’ve also seen how deeply nuanced the region is, shaped by rich, diverse, fascinating, and powerful cultures. And I use the word powerful intentionally—because LATAM, as a region and a culture, is powerful. That’s why it’s critical that we invest time, effort, and resources into truly understanding these nuances, rather than relying on broad-stroke assumptions.

This applies not just from a business perspective but also from a social one. Whether addressing the humanitarian crises LATAM faces or supporting the region’s development through investment, the goal should never be for LATAM to become like North America or anywhere else.

Instead, the world needs to better understand who LATAM really is and facilitate more of that.

One of the biggest shifts we’re seeing in research and data collection—especially in LATAM—is how technology is making insights more immediate and accessible, yet at the same time, there are still huge gaps in understanding. There’s an increasing reliance on digital tools, mobile methodologies, and AI-driven analysis, which allows us to get closer to the consumer in real time. But the challenge remains: how do we ensure that we’re reaching all people, not just the ones who are easiest to reach? In LATAM, just like in Africa, there are deep cultural nuances that can’t always be captured through traditional surveys alone. This is where innovative research methods—such as mobile-based data collection and innovative qualitative techniques—are becoming essential. People in this region have strong opinions and a powerful voice, and it’s up to us as researchers to design studies that don’t just scratch the surface but truly uncover the ‘why’ behind behaviors, perceptions, and decisions.

The call center in Panama is a game changer. It’s one thing to conduct research remotely, but having a physical presence in the region brings us so much closer to the realities of LATAM—what people are experiencing right now rather than just relying on outdated or secondhand information. We saw this firsthand in our recent Central America Migration study, which was conducted from our Panama-based center. Having trained local interviewers made all the difference—they understand the context, they speak the language and in a way that resonates with respondents, and they can probe in ways that an online survey never could.

This type of human-led research is critical, especially in regions where migration, economic uncertainty, and security concerns are shaping everyday life. Beyond that, the Panama call center also strengthens trust. In many LATAM markets, people are skeptical of research if they don’t feel a connection to who is asking the questions. By being here, by speaking their language (literally and culturally), we’re not just collecting data—we’re building relationships, and that’s what leads to truly meaningful insights.

LATAM like Africa, is not a country. It’s important to respect and understand each country within the region – the nature of the land itself and how this influences culture (i.e. Andean Culture vs. Caribbean Culture) – these nuances are crucial, fascinating and when businesses truly invest in understanding these cultures BEYOND the borders of countries, not only will they play a role in uplifting the communities and people within LATAM but businesses will flourish because you are truly reaching and understanding who the real LATAM customer is. And when you truly reach and understand who the real customer is, business success naturally follows.

I believe research is one of the most powerful tools that bring us closer to really understanding each other and ourselves as human beings. It’s beyond Company and. Customer, Country and Population. We are consistently in research with each other. Research allows us to build a relationship with our customers, with our people. It allows us to bring that relationship to life and deepen the relationships whether it be a business and its customer or a government and its people.

For me, research is truly the key that unlocks all opportunities for us to improve as a humanity and as professionals.

The ability to pivot as quickly as the market is changing. We live in a world where now more than ever, the only thing that is certain is that nothing is for certain. GeoPoll is a company that thrives on values that consistently questions the norm, the way things have always been done – is that the right way? Is there a better way? GeoPoll is a company that truly embodies one of my favourite philosophies from Nelson Mandela “everything seems impossible until it’s done”.

The company is agile enough to shift with the market while still building relationships with deep integrity—with employees, clients and respondents. And that’s why the data we deliver isn’t just insightful—it’s grounded in truth. Even as the truth itself continues to evolve.

Fun Fact – I am equally obsessed with both cats and birds!

Sobering Fact – In 2018, I lost both my parents within the space of 11 months at the age of 32. Becoming an orphan at that stage of my life was something I never expected. Grief has a way of reshaping you, breaking you apart while simultaneously rebuilding you into someone new—if you allow it. As difficult and painful as the journey has been, it has also been profoundly transformative, teaching me resilience, perspective, and a level of acceptance and compassion so deep it’s hard to articulate. I could never fully capture its impact in just a few words but what I can say with certainty is that loss, though brutal, has changed me for the better in ways I never, ever could have imagined.

The post Donna-lee Ginsberg on Conducting Research in LATAM appeared first on GeoPoll.

]]>The post The Top TV and Radio Stations in Kenya – 2024 appeared first on GeoPoll.

]]>The media landscape in Kenya continues to evolve, with television and radio remaining key sources of news, entertainment, and engagement for millions of people. GeoPoll’s Audience Measurement (GAM) data from January to December 2024 offers insights into the most-watched television stations and most-listened-to radio stations nationwide. This report provides an overview of audience preferences, peak listening and viewing times, and regional radio dominance.

Understanding these general trends is essential for broadcasters, advertisers, and media planners looking to make data-driven decisions in a highly competitive space.

As you read through this overview, remember that this report provides just a high-level summary of audience trends in 2024. There are usually month-by-month and week-by-week changes that are not accounted for in this report. For deeper insights, such as hourly audience fluctuations, detailed regional breakdowns, advertising effectiveness, and content performance analysis, please reach out.

Television continues to attract large audiences in Kenya, with Citizen TV maintaining its position as the most-watched channel. Other major stations such as NTV, KTN, KBC, and Maisha Magic East also reached a significant number of viewers to round up the Top 5.

| Rank | Stations | Reach % |

| 1 | Citizen TV | 79 |

| 2 | NTV | 67.7 |

| 3 | KTN | 67.1 |

| 4 | KBC | 64.2 |

| 5 | Maisha Magic East | 64 |

| 6 | K24 | 63.4 |

| 7 | TV 47 | 62.5 |

| 8 | SuperSport | 61 |

| 9 | KTN News* | 60.7 |

| 10 | Akili Kids | 60.2 |

*KTN News has since been merged with KTN.

Despite the onslaught by social media and podcasts, radio continues to serve as a primary information and entertainment platform in Kenya, reaching a wide audience across urban and rural areas. The most listened-to stations at the national level in 2024 were:

| Rank | Stations | Reach % |

| 1 | Radio Citizen | 72.4 |

| 2 | Radio Jambo | 68.6 |

| 3 | Radio Maisha | 68.1 |

| 4 | Milele FM | 64.2 |

| 5 | Classic 105 | 63.7 |

| 6 | Radio Taifa | 61 |

| 7 | Kiss FM | 59.6 |

| 8 | KBC English Service | 58.8 |

| 9 | NRG Radio | 36.9 |

| 10 | Kameme FM | 34 |

Breakfast shows are the prime of radio, with the highest radio listenership observed at this time block. Citizen Radio, Classic 105, Radio Jambo, and Radio Maisha attract the highest listenership, driven by their lifestyle and political morning talk shows.

Despite the dominance of national giants, vernacular radio stations held significant influence in their respective regions. In Central Kenya, Kameme FM and Inooro led the market. Kaya and Msenangu were the top vernacular stations in the Coast region, while Ramogi and Mayienga were popular in the Lake Region. In Lower Eastern, Musyi and Mbaitu dominated, and in the Rift Valley, Chamgei and Emoo led the airwaves. Egesa and Minto were prominent in South Nyanza. Western Kenya was more fragmented, with the top vernacular stations Ingo, Mulembe, and West Kenya being 7th, 8th, and 9th, respectively, in a region dominated by national Swahili stations. Similarly in Nairobi, being cosmopolitan, vernacular stations recorded less share, with Kameme FM the only vernacular station in the Top 10 (9th).

| Region | Top Vernacular Station | Market Share (%) |

| Central | Kameme FM | 16.4% |

| Coast | Kaya FM | 7.3% |

| Lake | Ramogi FM | 22.8% |

| Lower Eastern | Musyi FM | 10.2% |

| Nairobi | Kameme FM | 5.1% |

| Rift | Chamgei FM | 8.1% |

| South Nyanza | Egesa FM | 20.6% |

| Western | Ingo FM | 4.1% |

| Upper Eastern | Meru FM | 8.2% |

Overall, Radio Citizen was the leading station in the Coast, Lower Eastern, Upper Eastern, Western, and Rift regions. Classic 105 led in Nairobi, Kiss FM in the Lake region, and Egesa FM in South Nyanza.

GeoPoll provides real-time, data-driven insights into media consumption patterns in Kenya and across the world. Whether you need daily audience measurement, on-demand media analytics, or a customized report covering a specific time period, GeoPoll Audience Measurement offers the tools to help you make informed decisions for media advertising or programming.

The post The Top TV and Radio Stations in Kenya – 2024 appeared first on GeoPoll.

]]>The post MEAL: Using Mobile to Track the Impact of Donor-Funded Projects appeared first on GeoPoll.

]]>Take the example of a MEAL tracker GeoPoll did with a partner in the development sector in South Sudan. The year-long project aimed to monitor food security interventions in real time using mobile-based surveys. GeoPoll used SMS surveys to collect feedback from thousands of beneficiaries every week for a year, allowing for immediate program adjustments and enhanced impact reporting to donors. This near real-time MEAL approach led to improved, continous decision-making and resource allocation.

Successful MEAL strategies rely on a combination of timely data collection, community engagement, and iterative learning. Organizations must focus on:

Mobile technology is revolutionizing MEAL by offering real-time, scalable data collection solutions. GeoPoll’s mobile-based surveys enable NGOs, donors, and policymakers to:

Donors require transparent, data-backed impact reports to validate funding effectiveness. Mobile-based MEAL tools support this by:

Recently, mobile-based MEAL solutions have transformed the way NGOs, donors, and policymakers track project success. With proven impact now a core concern for donors, organizations use mobile technology to enhance monitoring efficiency, improve accountability, and generate real-time insights that drive impactful decision-making. As digital tools become more accessible, integrating mobile into MEAL strategies will be key to ensuring the success of donor-funded projects worldwide.

For the last decade, GeoPoll has perfected mobile-based MEAL solutions tailored for emerging countries. Our platform enables real-time data collection, analysis, and impact reporting to drive data-informed decision-making. Learn more about how GeoPoll can support your MEAL strategies—contact us today!

The post MEAL: Using Mobile to Track the Impact of Donor-Funded Projects appeared first on GeoPoll.

]]>