The Olympics are back! After being postponed in 2020 due to the coronavirus pandemic, the games are set to begin on July 23, 2021, in Tokyo, Japan. Although surging COVID-19 rates in Tokyo have forced a ban on in-person fans at events, as many as 4 billion people are expected to experience the Olympics in some form, including watching events live on TV, streaming clips on social media, and being bombarded with ads and logos from sponsors.

In the week prior to the start of the games, GeoPoll conducted a survey to gather information on planned viewing habits, betting activities, and brand/ad awareness surrounding the event. The study was conducted using GeoPoll’s mobile web platform, surveying more than 3,600 respondents in Kenya, Nigeria, South Africa, Ghana, Tanzania, Egypt, Brazil, Colombia and China. The topics covered include:

- Interest in sports and the Olympics

- Intent to watch or follow the games

- How people plan to watch/follow the games

- Most anticipated events and athletes

- Advertisements and brands associated with the games

- Opinions about the decision to move forward with the games despite ongoing concerns related to COVID-19

- Involvement in sports betting and plans to bet on the Olympics

This post details the initial insights from our survey. View and sort the data across demographics using the interactive dashboard below.

Olympics Viewing Interest and Intent

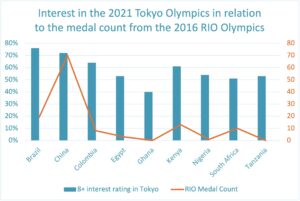

Respondents report strong overall interest in both sports in general and the Olympics. More than 1 out of 4 (29%) rate their interest in the Olympics a 10 (“very high”) on a 10-point scale. More than half (58%) rate their interest an 8 or higher. Respondents in Brazil and China express the most interest, with 76% and 72% respectively rating it an 8 or higher. In Ghana, only 40% rate their interest that high. Men express more high-level interest (62%) than women (57%), and older respondents (ages 36+) express far more interest than respondents ages 16-25 (66% to 56%).

Interest in the Tokyo Olympics shows at least some relation to success in previous Olympics. The chart above shows the percentage of respondents in each country that rated their interest in the Tokyo games an 8 or higher on a 10-point scale in relation to the overall number of medals won by each country in the 2016 games in Rio de Janeiro.

When asked to compare their interest in the Tokyo Olympics to the 2016 Rio de Janeiro Olympics, most (53%) say they are at least somewhat more interested in the Tokyo games. Another 24% say they are equally interested.

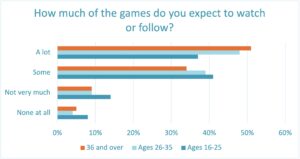

The substantial levels of interest overall explain why 46% of respondents plan to watch or follow “a lot” of the games. That number drops down to 37% for younger male and female respondents (ages 16-25). Only 5% across demographics do not plan to watch the games “at all.”

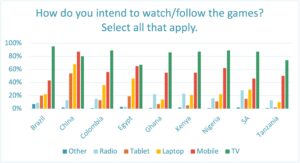

In most countries, the highest percentage of respondents by far plan to watch or follow the games via television. China and Egypt emerge as the outliers. In China, more respondents plan to follow the games using their mobile phones (87%) than television (80%). Most in China plan to follow the games using 3 or more different devices. Across countries, respondents ages 16-25 are more likely to use their phones than the older age groups, and men are more likely than women (61% to 53%).

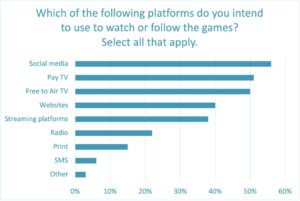

Out of all the respondents that plan to watch/follow the games to some extent, 56% plan to do it through social media. More respondents plan to watch the games via “Pay TV” (51%) than “Free to Air TV” (50%), and most (56%) claim to know which TV stations/channels will be showing the games. Respondents in China are the most informed, with 87% claiming to know. In addition to social media and TV, many also plan to follow the games using “websites” (40%) and “streaming platforms” (38%). Intended platform usage varies significantly across countries and age groups (see the dashboard below).

Variances between countries are even more pronounced when it comes to favorite events. Football/soccer stands out as the event respondents are most interested in watching in Brazil, Colombia, Egypt, Ghana, Nigeria, South Africa, and Tanzania. More than half the respondents in Egypt (54%) pick football as their favorite event.

Kenya’s dominant runners help make “athletics/track and field” the most anticipated event in that country (38%). Athletics is also highly anticipated in Ghana (19%) and South Africa (17%).

China has dominated table tennis more than any other country in any other Olympic sport. More than 50% of respondents in China pick table tennis as one of the five events they are most interested in watching, and 18% select it as their favorite event overall (much more than any other event in that country).

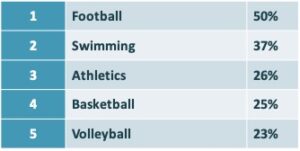

Across demographics, the five events respondents express the most interest in watching include:

When forced to pick one event, nothing comes close to football at 33%.

COVID-19 Concerns and Perceptions

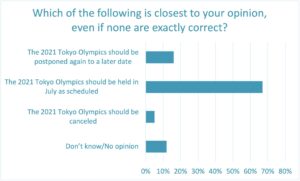

The coronavirus pandemic has cast a dark cloud over the Tokyo Olympics for the past year, leading to eventual postponement in 2020. With COVID-19 cases again on the rise, many Japanese citizens, media outlets, and members of the medical community are calling for the games to be cancelled. Respondents in our study, however, overwhelmingly believe the games should be held in July as scheduled (67%). Men are more likely to believe the games should go on as planned than women (71% to 62%). Only 5% of respondents believe the 2021 Tokyo Olympics should be canceled. Respondents in China, the closest country in proximity to Japan, and South Africa, which is currently dealing with a devastating third wave of the virus, are the most likely to believe the games should be postponed again to a later date (26% and 28% respectively).

Despite Japan setting strict rules for athletes and spectators to prevent the spread of the virus, several cases have been reported in the week before the games, including three members of the South African football squad. It is unclear whether any athletes that tested positive had been vaccinated. In our study, 58% of respondents strongly support requiring all athletes to be vaccinated in order to compete. Attitudes vary significantly by country, however. In Kenya, 70% strongly support mandatory vaccination compared to 32% in Tanzania. Tanzania has the highest percentage that strongly opposes mandatory vaccination at 17%, likely due to the late President Magafuli’s anti-vaccine stance. Older respondents (ages 36 and over) are more likely to strongly support vaccination than respondents ages 16-25 (64% compared to 52%).

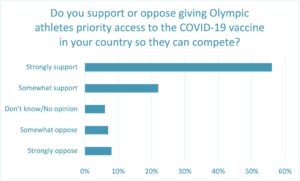

Vaccine availability and distribution remain serious issues across the globe, particularly in developing nations, including several surveyed in this study. Despite delayed vaccine rollouts in their country, most respondents in Kenya (72%), Ghana (68%), Colombia (63%), South Africa (58%), Nigeria (56%), and Brazil (55%) strongly support giving Olympic athletes priority access to the vaccine. Older respondents are more likely to strongly support prioritizing athletes than younger respondents (65% to 48%). Tanzania once again has the lowest percentage that strongly support giving athletes priority access to the vaccine (33%) and highest percentage that strongly oppose it (16%).

Betting on the Olympic Games

The global sports betting industry reached a market size of 203 billion U.S. dollars in 2020. Many countries participate in legal sports betting, one of the more recent additions being the United States in 2019. The increased availability and penetration of mobile technology around the world has played a major role in the recent upsurge in sports betting and paints a bright outlook for its future. According to a report by Technavio, the global sports betting market is expected to grow by $144.44 billion between 2020-2025.

In our study, more than half of respondents (53%) say they have engaged in sports betting in the past. Men are much more likely to have engaged than women (60% to 45%). Most men (67%) and women (50%) ages 26-35 have engaged in betting.

In Kenya, like in many other African countries, gambling is classified and positioned as a legitimate recreational and leisure activity. More than 71% of respondents in Kenya report having engaged in sports betting in the past. At the lower end of the range, only 28% of respondents in Egypt have engaged in sports betting. Egypt and Brazil (43%) are the only countries in our survey below 50%.

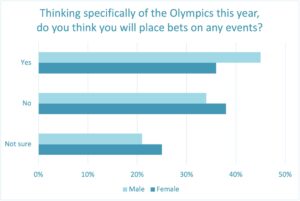

The sheer volume of events and athletes included in the Olympics presents a variety of opportunities for sports betting. While 41% of respondents across demographics plan to place bets on an Olympic event, 23% say they are “not sure” – suggesting the number of actual bettors could rise. Almost half of respondents ages 26-35 plan to bet (46%) compared to just 38% of the other age groups.

Nigeria and South Africa form two of the largest sports betting markets in Africa. They also express the most interest in placing bets on the Olympics (48% and 46% respectively). At the other end of the scale, only 27% of respondents in Egypt and 28% of respondents in Brazil plan to place bets.

Interactive Data Dashboard

Dive deeper into GeoPoll’s data on the interests, planned viewing habits, and betting behaviors surrounding the 2021 Olympics using the dashboard below. You can view all the data from this study, filterable by country, age group, gender, and question.

Conduct Further Research with GeoPoll

GeoPoll is the pioneer in conducting remote research through mobile-based methodologies in Africa, Asia, and Latin America. Our custom research capabilities allow agencies, brands, and international development organizations to conduct one-off or ongoing surveys on any topic, with results delivered in near real-time.

This GeoPoll survey was conducted using GeoPoll’s mobile web platform in the week prior to the start of the 2021 Tokyo Olympics in Kenya, Nigeria, South Africa, Ghana, Tanzania, Egypt, Brazil, Colombia and China, surveying approximately 400 respondents from each country. It is not purely a scientific study as there were no strict measures to limit demographic quotas such as location, gender, and age groups. However, a good mix of young and old, urban and rural, and men and women with a natural distribution was achieved.

To request more information about this study or further studies on Olympics viewership and audience measurement, or to get a quote for an upcoming project of your own, please contact us.