Concept testing is a research method that involves evaluating ideas or concepts with a target audience before it becomes available to the public. It helps gauge the willingness of customers to buy or engage with new products, advertisements, or messaging, and make critical decisions before the launch of a new concept.

Whenever a company or organization is looking to launch a product or start developing a new idea, it is essential to conduct concept testing to identify the perceptions, needs, and preferences of their target audience. By testing a concept before launching, businesses can see if their concepts will resonate and adjust them if needed, saving valuable advertising spend and ensuring a higher return on investment.

Uses of concept testing

Concept testing can be used to make important decisions that form the backbone of a product or service offering, advertising campaign, or even the branding of an entire business. Businesses, and even humanitarian organizations, can apply concept testing in virtually endless scenarios. Here are a few examples of concept testing use cases:

- Pricing: Whether you are pricing a new product or reviewing your prices, it is essential to test how customers may react to price changes and identify how much they value your product. Concept testing can help determine how you should charge for your product.

- Branding and messaging: Concept testing helps identify the optimal messaging that resonates with users and allows them to understand how to appeal to customers. For example, by testing multiple concepts, brands can pinpoint the most effective logo and brand colors, website design, and ad messaging.

- Package testing: Packaging, especially for FMCG products, plays a vital role in sales. Concept testing can demonstrate how consumers perceive products from their packaging and if it’s visually appealing and considered high quality by the target audience.

- Market measurement: Concept testing provides understanding of potential and current customers and the different customer segments. Knowing what demographic groups likes a concept the most and why can help product marketability and refine go-to-market strategies.

- New products or services: Concept testing is widely used by companies to make decisions while developing new products, to find out which features interest customers most and which need to be removed or reworked. Testing products and features help create useful products for the users and reduce the pain points customers face with existing features.

Methods of concept testing

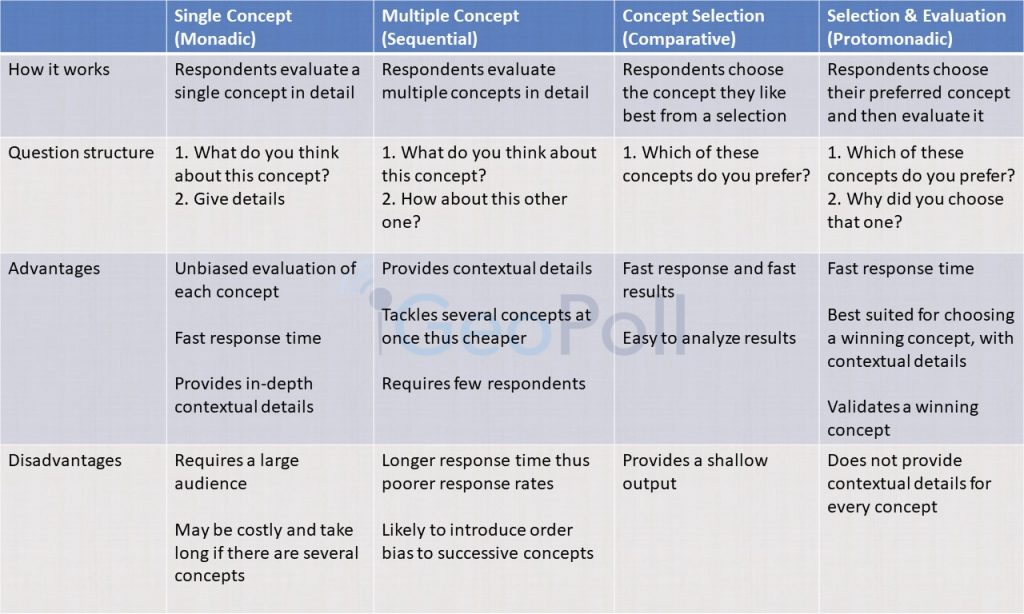

There are several different kinds of concept tests, which can each be adapted to the test purpose. Below are the most used concept testing methods:

- Single concept evaluation (Monadic) – In a monadic test, respondents complete a full evaluation of a single concept. Since the respondents see only a single concept, it is possible to go in-depth while keeping the survey short and then ask follow-up questions about the various attributes of a concept. If there are several concepts to test, the sample is broken into multiple groups with each group analyzing one concept. As a result, monadic concept testing requires a large sample, which may be costly and time-consuming.

- Example: A brand might ask respondents to give their opinion on a proposed packaging concept and follow up with questions such as how the design compares with packaging for competing products, what they like or dislike about it, and how they feel about the colors and fonts. If there are several packaging designs, they would have to ask the same questions to different groups for each respective design.

- Multiple concept evaluation (sequential monadic) – In sequential monadic concept testing, respondents are presented with each of the concepts and then complete full evaluations for each of the concepts. As the respondents see all concepts, multiple concepts can be tested in a single round by a smaller sample, thus saving time and money, while providing feedback on differences and preferences between multiple designs. However, there is a risk of having long questionnaires, which may affect the completion rate.

- Example: The brand in the example above might show all the packaging designs, one at a time, to the same respondents and have them evaluate all of them. As a control for bias, the respondents can still be broken into groups with each group viewing each of the designs in varying order.

- Concept selection (comparative) – In a comparative survey methodology, respondents are presented with options to choose from in order to identify the strongest concept. Comparative tests give clear results and an easy way to determine which concept is the winner. However, it can be difficult to tell why respondents choose one concept over others, as there is little context provided as to why respondents chose one option over another.

- Example: Still using our example, in comparative testing, the brand could send images of all the packaging designs to all respondents and simply ask them to choose the design the prefer best and proceed with the winning package.

- Concept selection and evaluation (comparative-monadic/protomonadic) – The comparative monadic methodology is a sequential combination of the monadic and comparative methods. Respondents first choose the concept they like best and then complete a full evaluation of that concept. The protomonadic methodology yields useful diagnostic data, and the extra step provides context as to why the preferred concept was chosen.

- Example: GeoPoll worked with a major international development organization in testing the best name for a local youth program in Africa. We sent the various proposed names to different groups of respondents via mobile web links, asking them to choose the best option, and followed up with questions to establish why the respondents made their respective choices.

Here is a comparison table of the four concept testing methods:

How GeoPoll Conducts Concept Testing via Mobile

GeoPoll works with leading global organizations to test new concepts via video and picture surveys through mobile web links, mobile app surveys, and mobile-based focus groups. Our extensive respondent database enables the creation of inclusive samples from any target audience, and our unique mobile platform provides accurate, real-time data to make decisions on the go. To request detailed, tailor-made information, please contact us.