How fashionable are you? What do you look for when buying clothes, shoes, and other fashion items? Where do you get that information, and where do you ultimately shop?

To get answers to these questions and more, GeoPoll conducted an App study in Egypt, Nigeria, and South Africa. Here, we present highlights from the report and a dashboard of the report for you to look through if you would like through the granular findings and filter by country or age group.

Fashion Purchase Habits

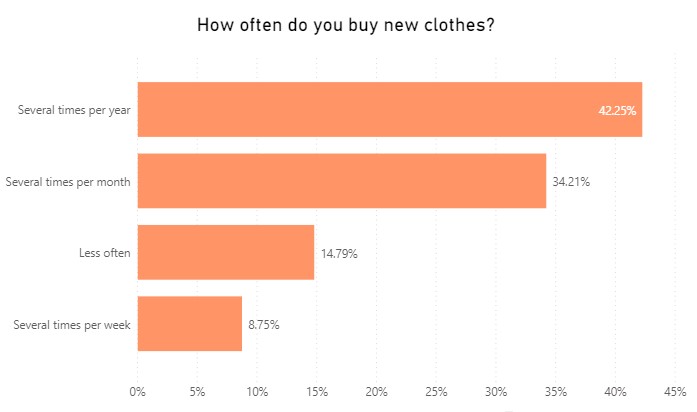

The first question we asked in the survey was how often the respondents bought new clothes. Forty-two percent said they buy clothes several times every year and 34% said several times per month.

The main reason for buying new clothes was to replace worn-out clothes (36%). A good number buy clothes for fun, whether because they enjoy buying new clothes (26%) or enriching their wardrobes.

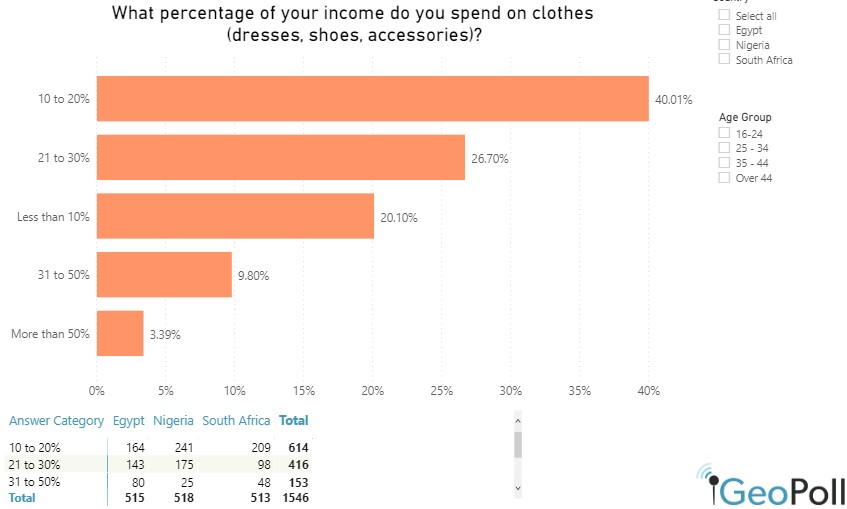

What percentage of their income do people use to buy clothes, shoes, and other fashion items? Seems like a substantial amount. The biggest portion of the respondents (40%) said they allocate between 10 and 20%, while an additional 26% said they spend between 21% and 30% of their income on fashion.

“Fashionability”

When it comes to the importance of being stylish, as expected, the younger people (between 16 and 34) mostly said they have to be fashionable (62%), in direct contrast with older people, who said they were more functional – don’t mind what they wear (61%), as long as it fits. ?

We observed a similar trend when we asked the respondents if they followed current fashion trends. Again, the younger ones are more likely to follow fashion trends either closely or to some extent. Between the countries, Nigerians follow fashion trends more (95%) than the other countries.

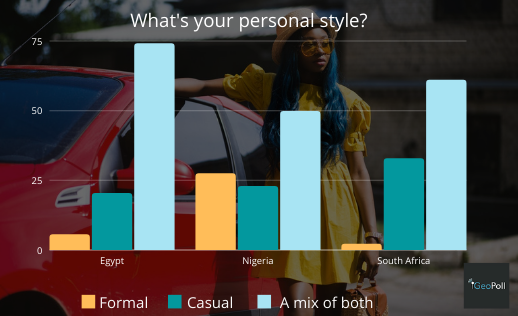

Most people said they wear a mix of both casual and formal (61%) in matters of personal style, with more people leaning towards casual than formal dressing.

“The older you get, the more function trumps over fashion.”

Brands and New vs. Used Clothes

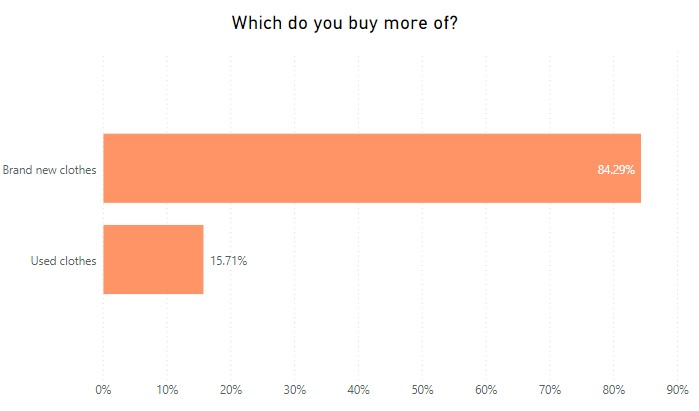

Over the years, there have been raging conversations around how secondhand clothes from other parts of the world form a thriving business in Africa. East Africa, for example, imports over $150 million worth of used clothes and shoes every year, and the industry employs 355,000 people, suggesting a significant demand for used clothes. However, the situation is changing, with cheaper clothes from countries like China and Turkey. In this survey, respondents in South Africa, which banned the importation of secondhand clothes, only 4.36% said they buy more used clothes than new clothes. This contrasts with Nigeria, where 28% said they buy more secondhand garments.

Regarding brands, 60% of the respondents said the brand name plays a role in their fashion purchases. This was most pronounced in Nigeria (73%) and least in Egypt (52%), and more in middle-aged individuals between 35 and 44 years old (66%) than in younger people.

Fashion Shopping Online

While Africa is experiencing massive growth in online shopping, a big portion (43%) of the respondents said they shop for clothes and shoes less online than offline, with 27% saying they never shop fashion online. A further 26% said they shop online more often than they shop offline, while 4% said they shop fashion online all the time.

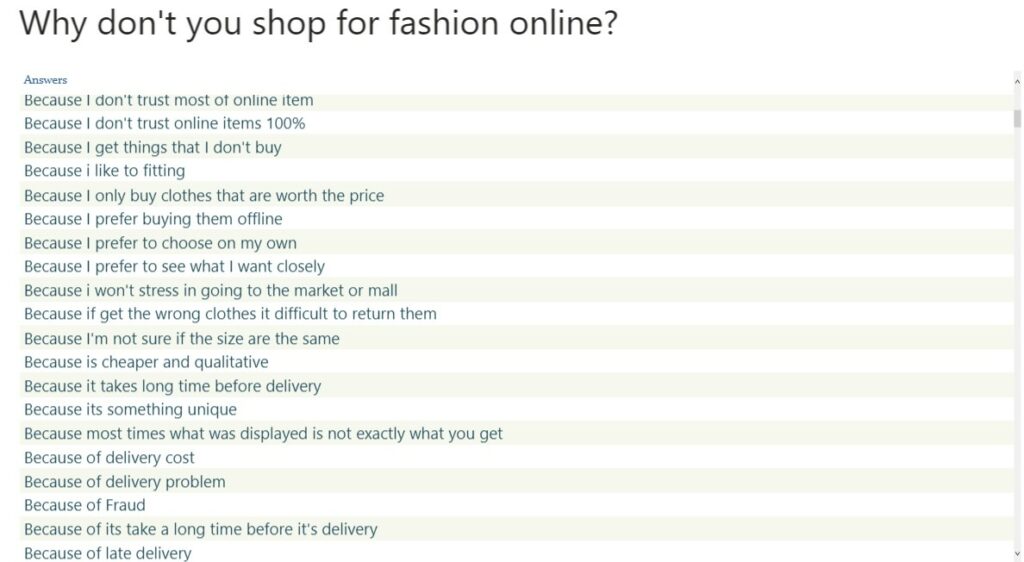

Probed on why they do not shop for shoes and clothes online, those who had said they either don’t shop online at all or less cited a variety of reasons. Trust, wrong sizes, and poor quality were the main reasons mentioned, with most people preferring to see, touch, and even fit before purchasing fashion items. See all the open-ended answers to this question in the second tab of the report below.

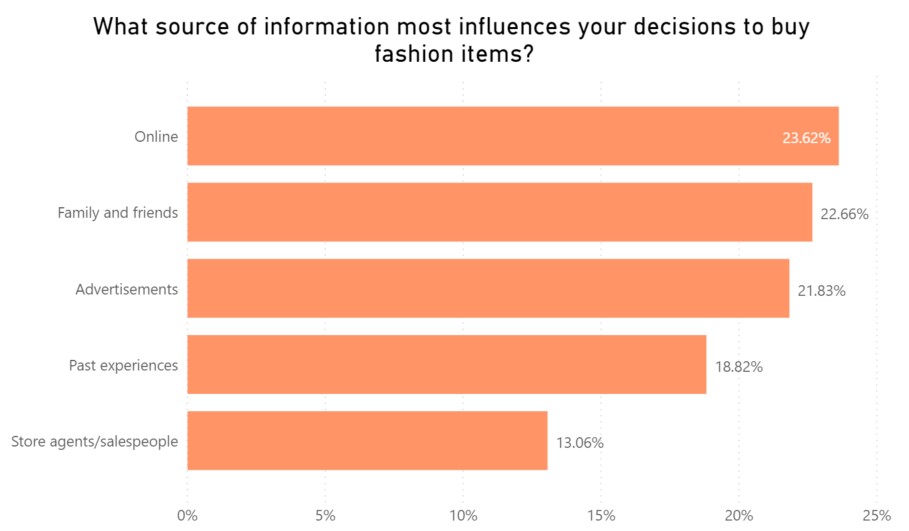

Although fewer people shop online, most people get information that influences their fashion shopping decisions online. Overall, 24% said they rely on online sources for such information, 23% look to family and friends for recommendations, and 22% are influenced by various forms of advertisements.

Although fewer people shop online, most people get information that influences their fashion shopping decisions online. Overall, 24% said they rely on online sources for such information, 23% look to family and friends for recommendations, and 22% are influenced by various forms of advertisements.

Digging deeper, however, we notice that these findings vary from country to country. Egyptians are more likely to buy fashion items that they have experience with (27%), Nigerians will go with what they see online (31%), and South Africans are more tuned in by ads (37%).

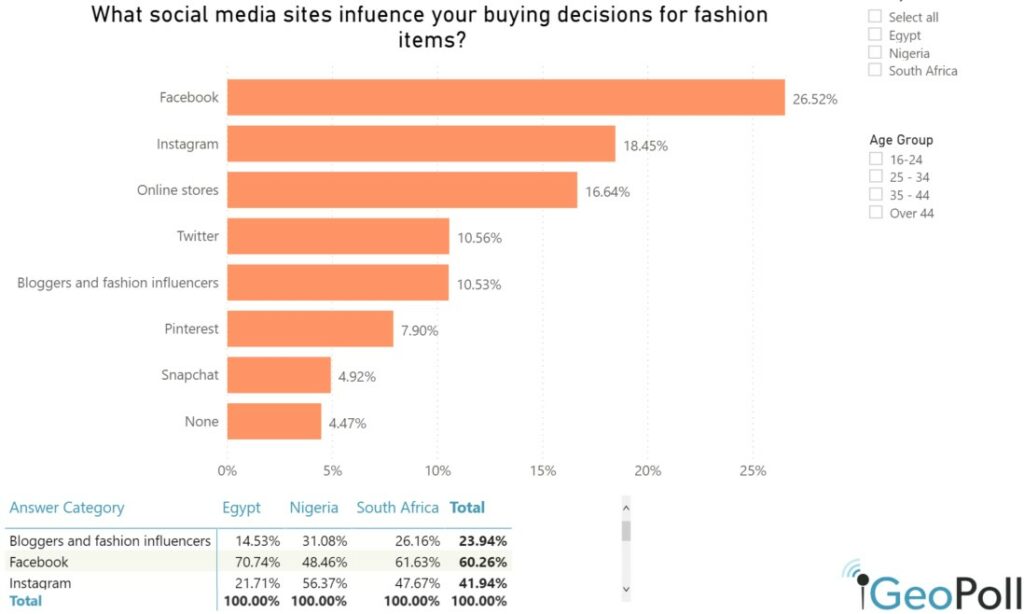

One of the biggest drivers of purchasing decisions globally is social media – people spend more time on social media sites and apps than other channels online. In this study, most of the people mentioned Facebook (27%) as the social media site that influences them most, followed by Instagram (18%) and e-commerce websites (17%).

The GeoPoll Fashion Report Dashboard

About this survey

This GeoPoll survey was conducted through the GeoPoll Community App in March 2020 in Egypt, Nigeria, and South Africa, surveying 520 respondents from each country. It is not strictly a scientific study as there were no strict measures to limit demographic quotas such as location, gender, and age groups. Therefore, the survey skews slightly towards younger, urban populations with a natural distribution.

To conduct a scientific study on fashion or other consumer trends and habits anywhere in Africa, Asia, and Latin America, please contact GeoPoll.