- Contents

Prior to the start of the Paris 2024 Olympics in July, GeoPoll, in collaboration with mediaReach OMD, conducted a survey to assess public perceptions around the games. The study was implemented using GeoPoll’s mobile web platform, surveying more than 2,250 respondents in Ghana, Kenya, Nigeria, and Tanzania. Topics covered included awareness of the games, interest, viewing intentions, favorite events, media consumption habits, betting trends, and perceptions of the event’s cultural and social impact.

Following the Closing Ceremony on 11 August, 2024, GeoPoll and mediaReach OMD reached out to respondents in Ghana and Nigeria again to explore how their actual viewership of the games compared to their pre-Olympics’ interest and intentions. The follow-up survey also assessed respondents’ intention to watch the Paris 2024 Paralympic Games and the Los Angeles 2028 Olympics. This post details findings from the follow-up survey.

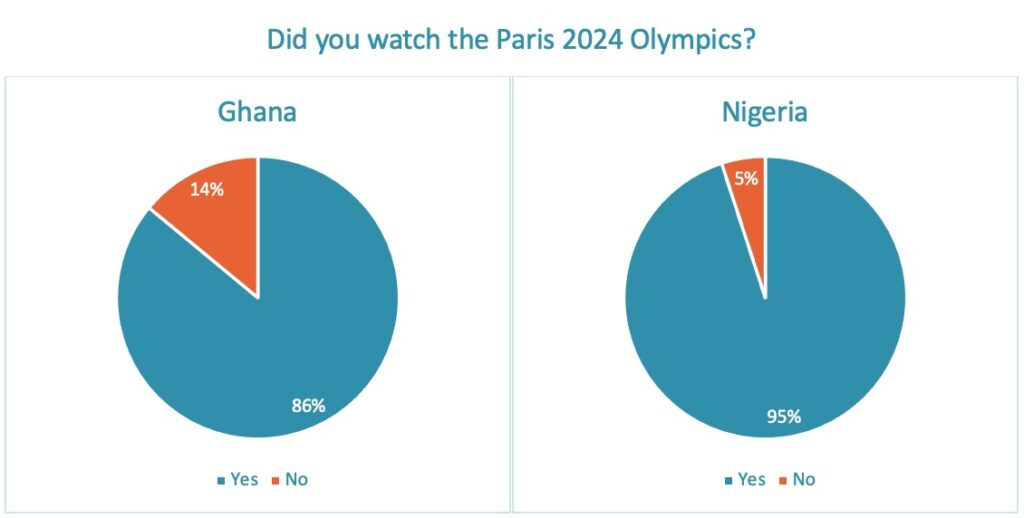

Viewership of the Paris 2024 Olympics

In the Pre-Olympics Survey, 97% of respondents in Nigeria and 92% of respondents in Ghana said they intended to watch the 2024 Paris Olympics. Although dropping slightly, the percentage of respondents that said they did watch the games remains exceptionally high. Almost all respondents in Nigeria claim to have watched (95%) along with 86% of respondents in Ghana.

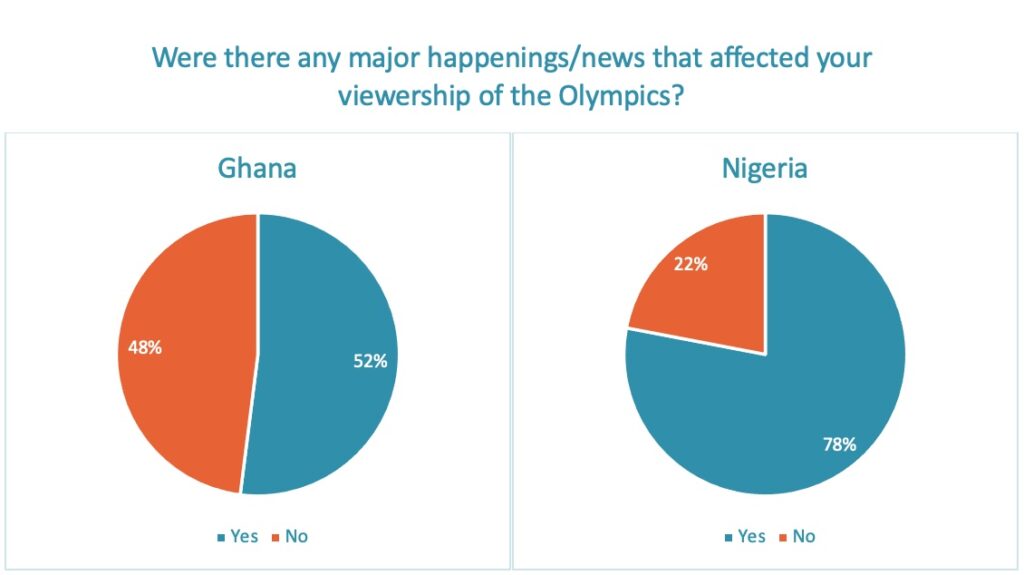

The slight decrease in actual viewership versus intent may be partially explained by the fact that a majority of respondents said there were major happenings or news that affected their viewership of the games.

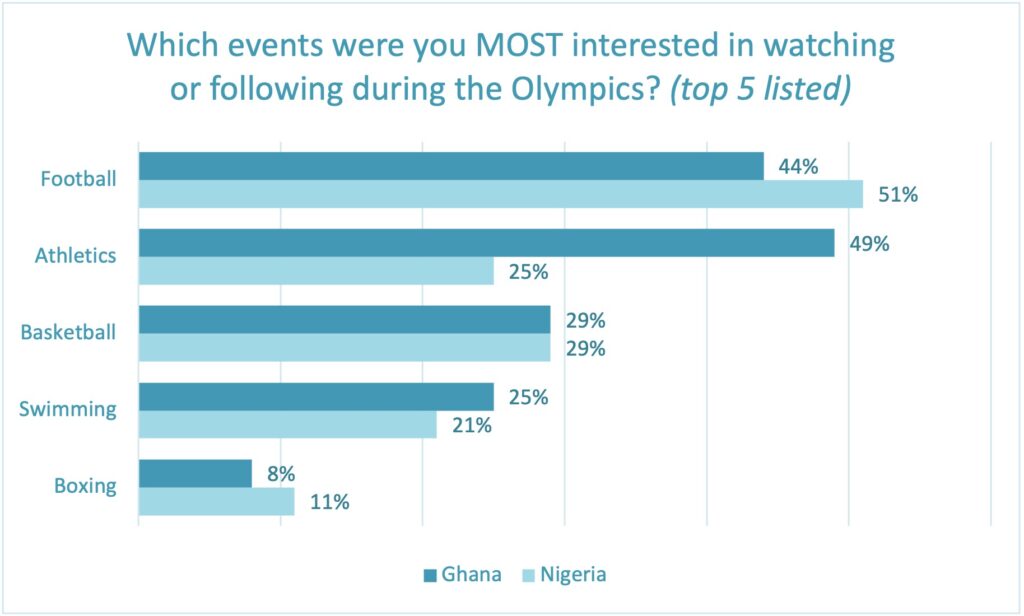

Across countries, the events respondents were most interested in watching include football, athletics, basketball, swimming, and boxing. Football was by far the most popular event in Nigeria (51%) while Athletics was the most popular in Ghana (49%).

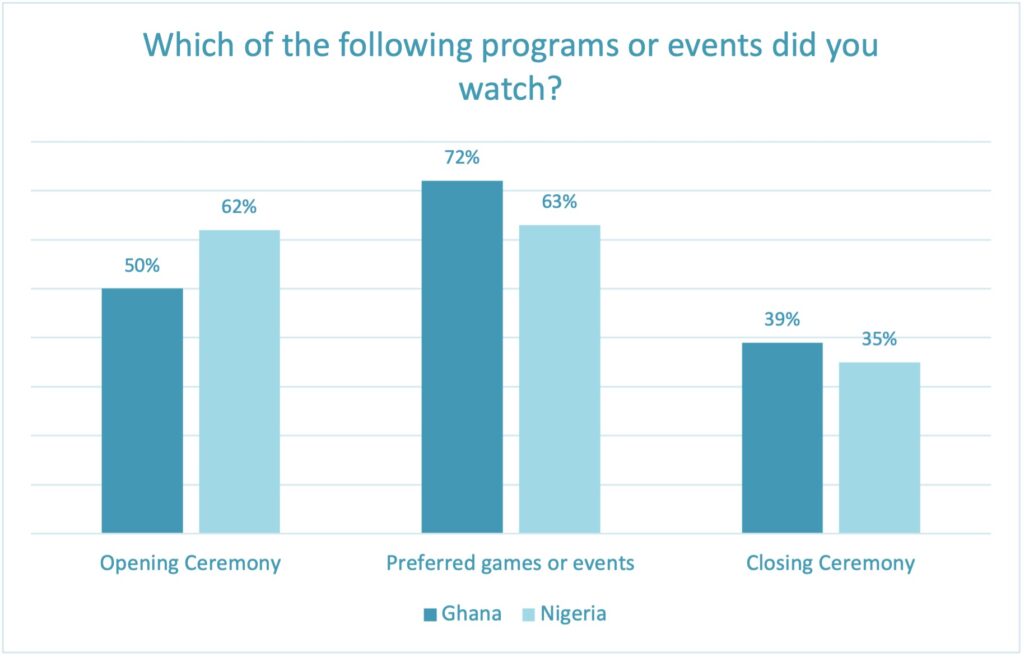

The fanfare of the Opening Ceremony drew a majority share of respondents in both Ghana (50%) and Nigeria (62%). An even larger share tuned in to watch their preferred games or events (72% in Ghana and 63% in Nigeria).

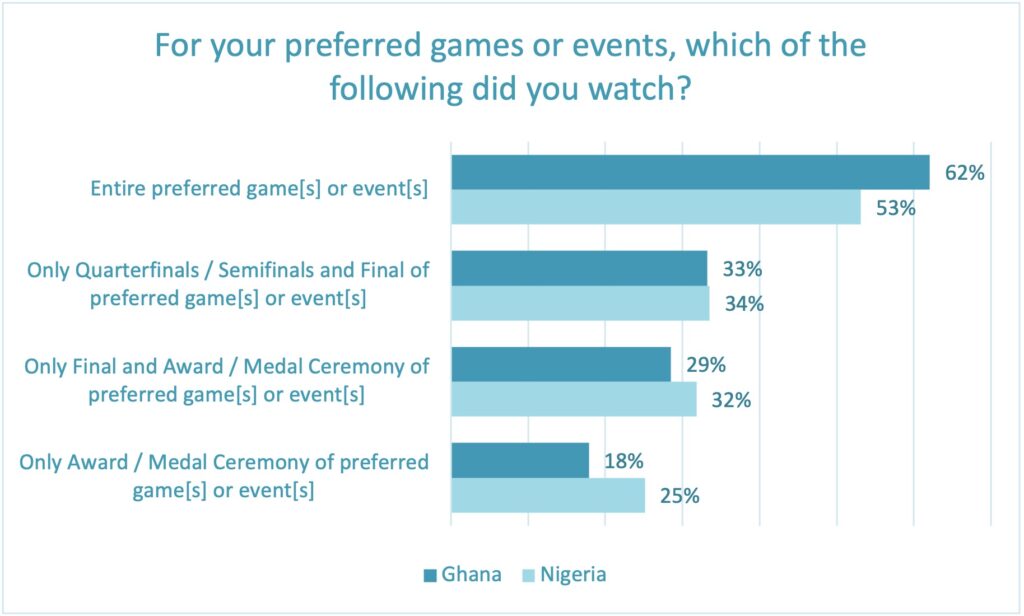

When it comes to following their favorite events, respondents are much more likely to watch the entire event than to just tune in for the quarterfinals, semifinals, finals, and/or medal ceremony.

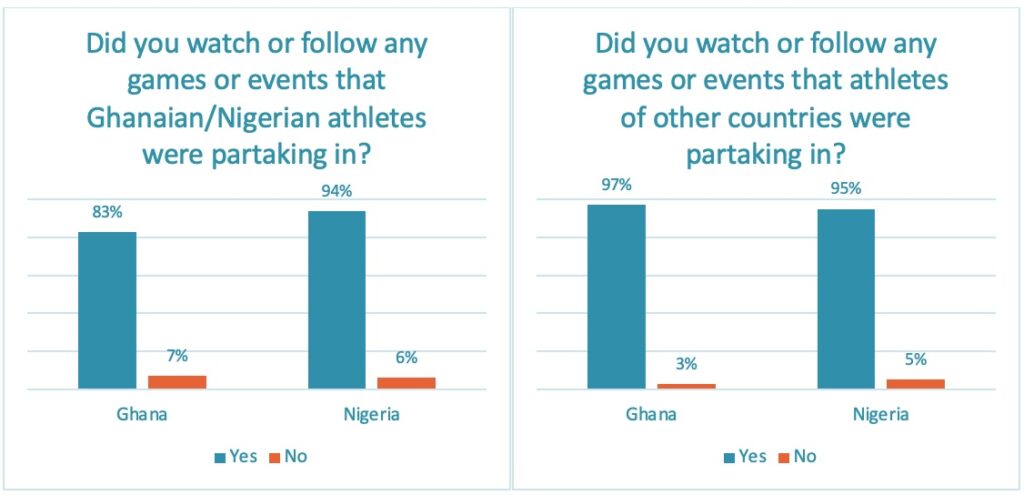

Interest in the games goes beyond borders. Respondents in Ghana and Nigeria were just as likely if not more likely to watch or follow games or events that athletes from other countries were partaking in than events with athletes from their own country.

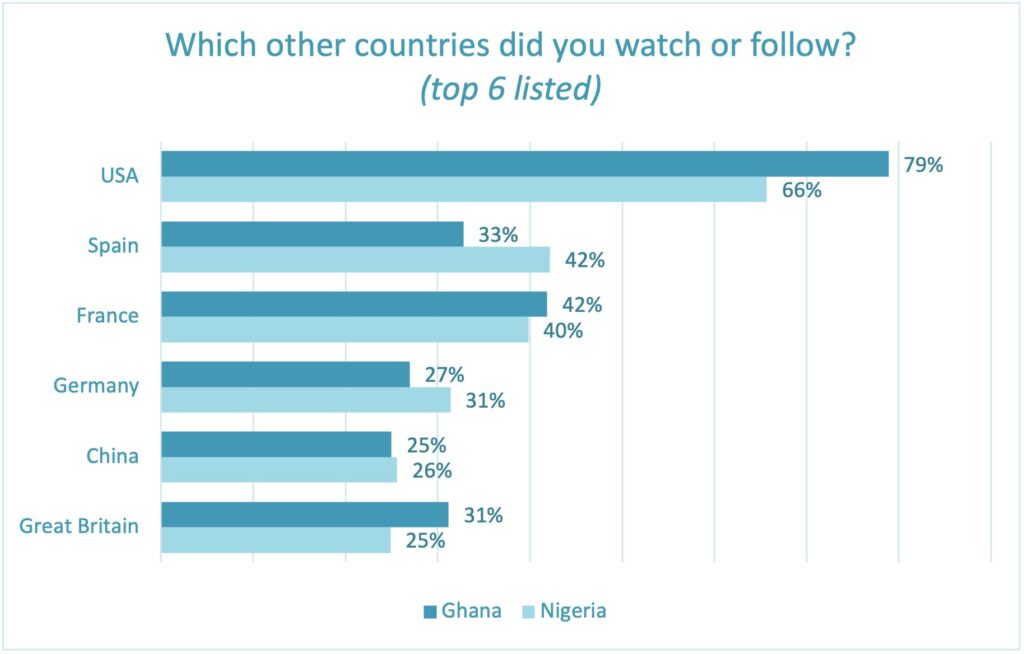

With the United States topping the gold and overall medal count, it follows that the majority of respondents watched games or events involving US athletes. Excitement around the gold medal match in men’s football between Spain and France, the men’s basketball final between the US and France, the women’s football final between the US and Brazil, and the women’s football bronze medal match between Germany and Spain help to explain the large number of respondents that watched events involving those countries.

Media Consumption Habits

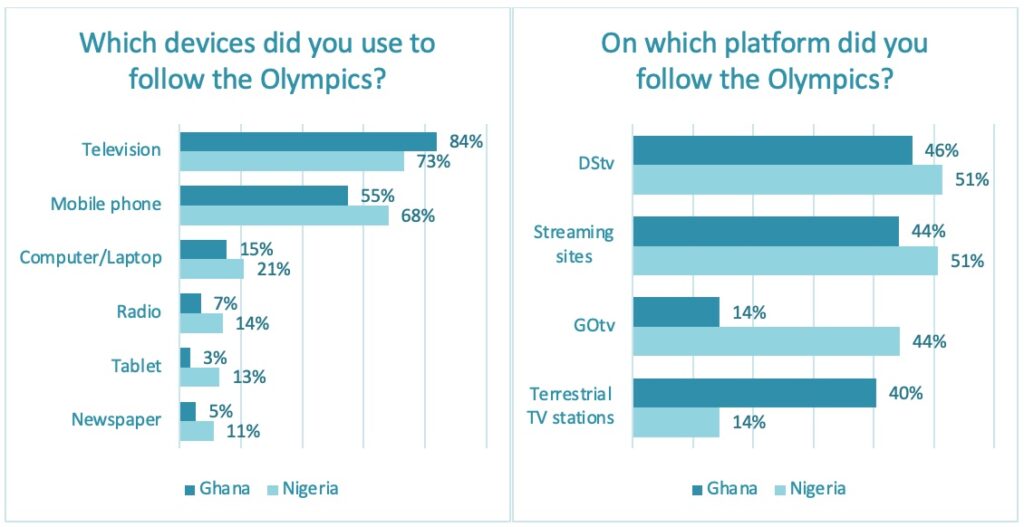

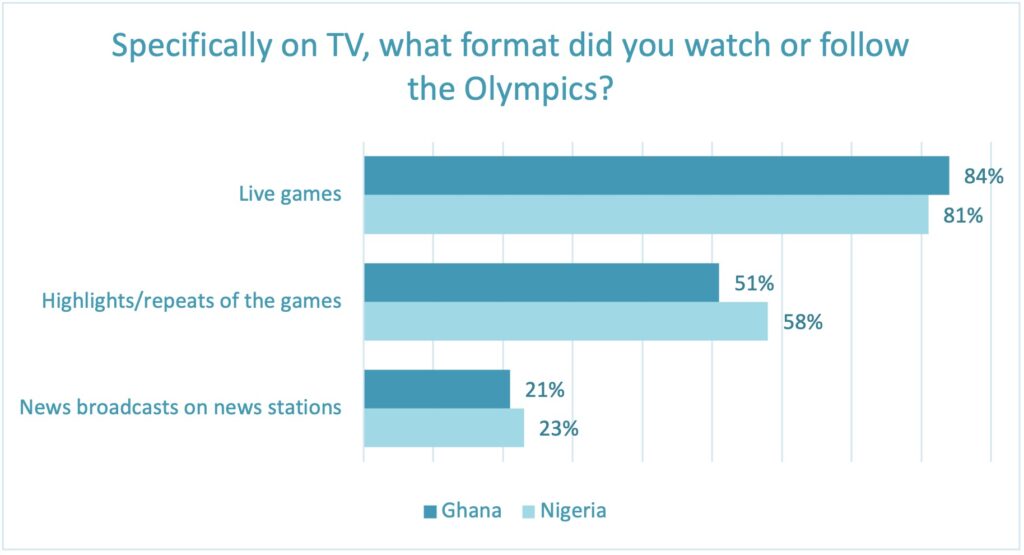

TV was the device of choice for watching the games, followed by mobile phone. Watching via mobile phone was particularly popular in Nigeria (68%). The top three platforms for watching the games in Nigeria were DStv (51%), streaming sites (51%), and GOtv (44%). In Ghana, the top three platforms were DStv (46%), streaming sites (44%), and terrestrial television stations (40%).

Respondents primarily watched the games live on TV rather than catching up via replays or news highlights.

In terms of setting, most respondents watched the games…

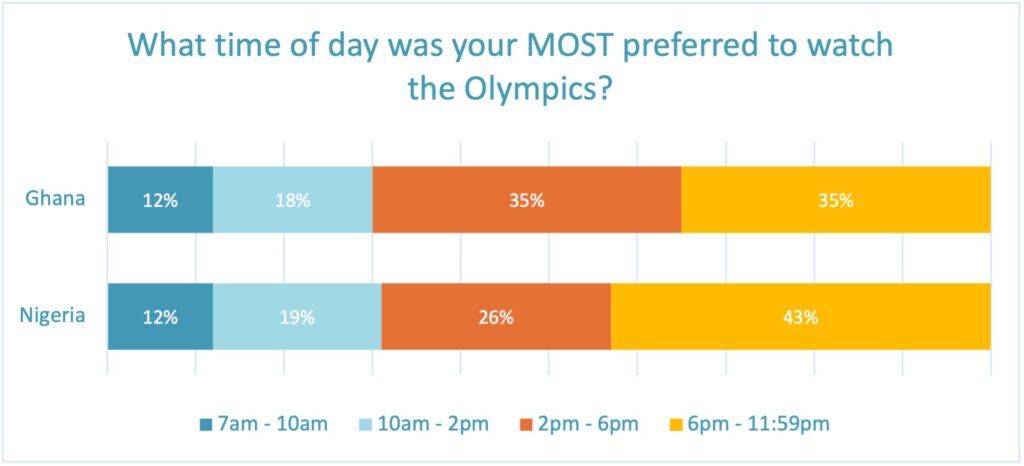

Viewership increased throughout the day, with the highest percentage of respondents watching in the evenings from 6pm to 11pm.

Olympics Sports Betting

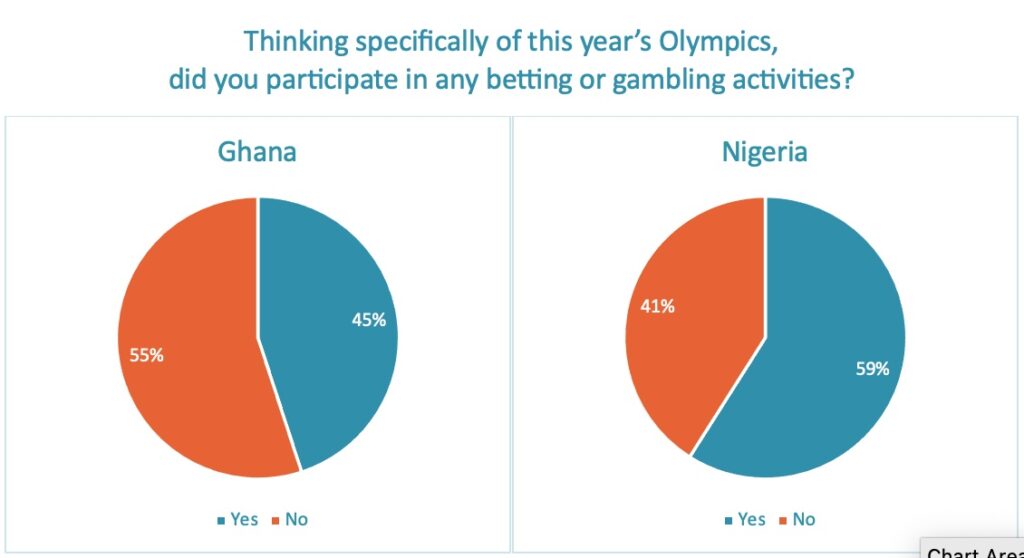

Betting on the Olympics primarily followed expectations leading up to the games. In the Pre-Olympic Wurvey, 42% of respondents in Ghana said they expected to participate in betting. After the games, 45% said that they did participate. In Nigeria, 61% expected to bet compared to 59% that actually did.

The most popular betting platforms in Ghana were SportyBet (63%), Betway (18%), and 1XBET (8%). In Nigeria the most popular platforms were Bet9ja (35%), SportyBet (28%), BetKing (11%), and 1XBET (11%).

Paris 2024 Paralympic Games

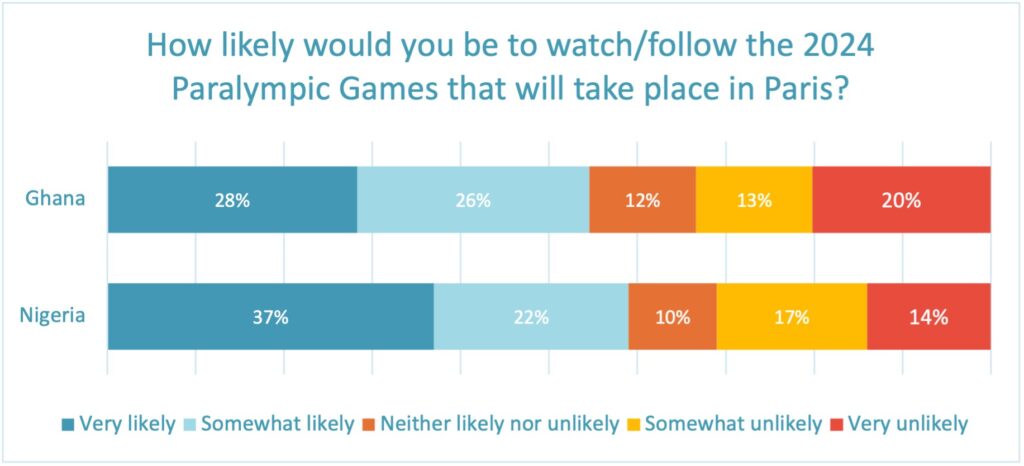

The Paris 2024 Paralympic Games were held from 28 August to 8 September. Prior to the games, most respondents in Ghana were aware that Ghana would be participating in the games (75%). Awareness climbed to 83% in Nigeria. The majority of respondents in both countries said they were at least somewhat likely to follow the games.

Los Angeles 2028 Olympics

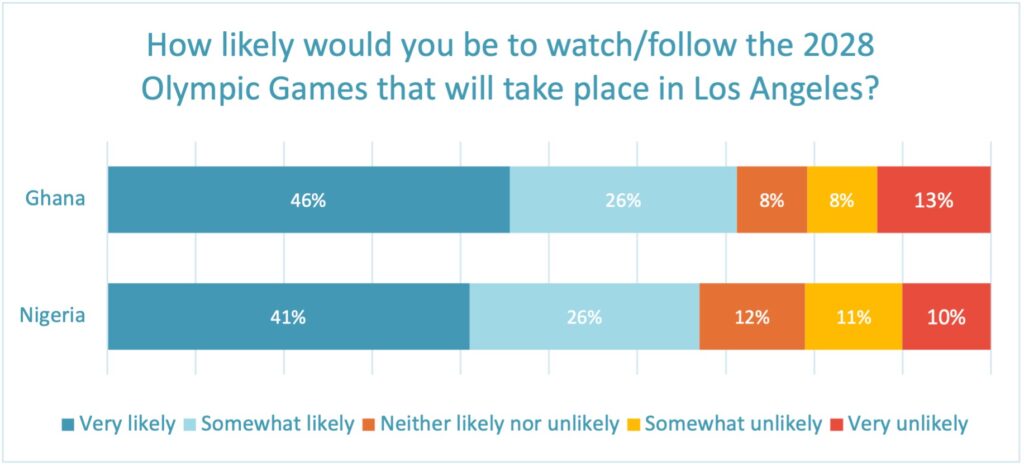

Looking ahead, 72% of respondents in Ghana and 67% of respondents in Nigeria said they are likely to watch or follow the 2028 Los Angeles Olympics.

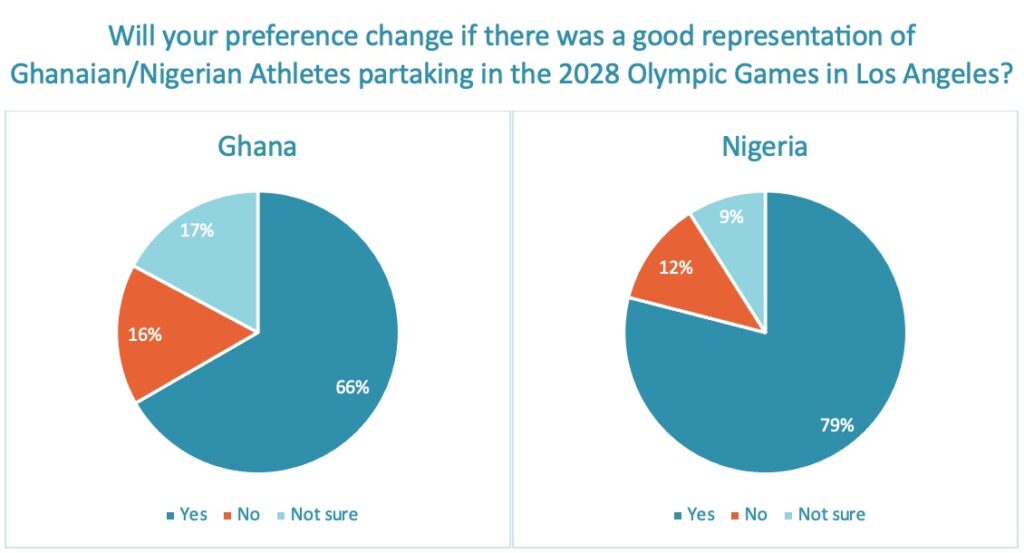

Disappointment in their team’s success in Paris, particularly for fans in Nigeria, is likely dampening excitement for Los Angeles. When asked if their likelihood to watch the 2028 Olympics would change if there was a good representation of Ghanaian/Nigerian athletes, 66% of respondents in Ghana and 79% in Nigeria said that it would.

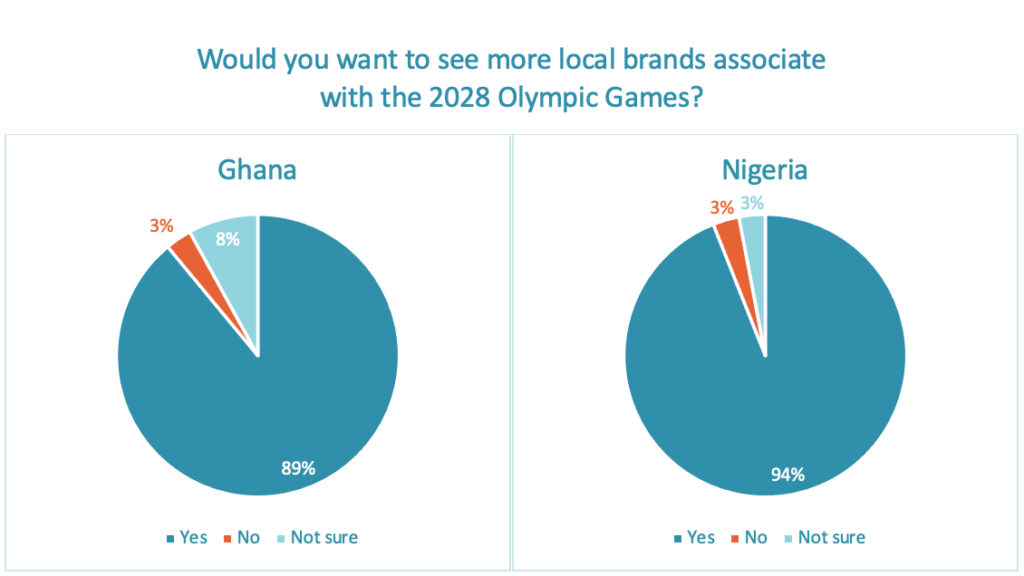

In addition to wanting to see a good representation of local athletes, almost all respondents said they would like to see more local brands associate with the 2028 Olympics in Los Angeles.

Olympics Fan Experiences

Fans have always played a vital role in sport, and when it comes to the Olympics, the shared experiences of fans help bring together entire nations in support of their athletes. While fan experiences have traditionally revolved around the live event and arena of the games, fan experiences today can be both physical and digital, extending beyond the borders of the host country into the homes, bars, screens, and public spaces of participating countries around the world.

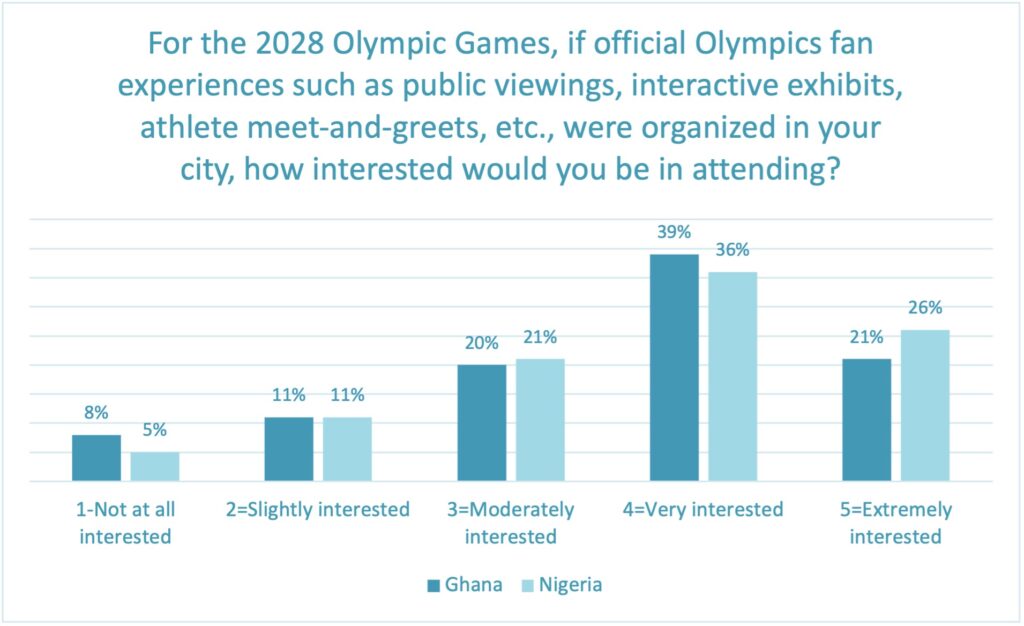

In our study, we asked respondents how interested they would be in attending official Olympics fan experiences for the 2028 Olympics in their home city, such as public viewings, interactive exhibits, athlete meet-and-greets, etc.

In both Ghana and Nigeria, most rate their interest in fan experiences as either very interested or extremely interested.

About This Survey

GeoPoll conducted this survey, in collaboration with mediaReach OMD, using its proprietary mobile web research platform. The survey reached 1,176 respondents, leveraging the OMD Consumer Intelligence (OCI) panel in Ghana and Nigeria.

Data collection occurred from 21-27 August, 2024.

The diverse sample for the study includes a gender composition of 73% male and 36% female, and an age breakdown of 8% ages 18-24, 53% ages 25-34, and 40% ages 35 and older.

For more information on the sample and methodology for this study or to conduct a research study of your own in Africa or around the world, contact GeoPoll today.

For more information about mediaReach OMD and its services, please visit www.mediareachomd.com.

To view the detailed report with findings and insights gathered prior to the 2024 Paris Olympics, please visit the OMD Consumer Intelligence Platform or download the report here: https://www.mediareachomd.com/olympicsreport